Published 17:54 IST, August 17th 2024

Mpox drugmaker’s shares may provide false comfort

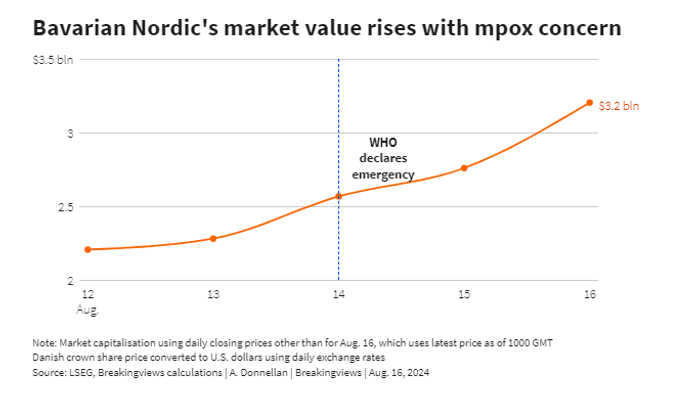

The market price of a company that makes a vaccine, Denmark’s $3.2 billion Bavarian Nordic, at least offers some clues.

- Opinion

- 3 min read

Dose of reality. Global public health emergencies are always shrouded in uncertainty. Mpox, which has spread beyond central Africa, is no exception. The market price of a company that makes a vaccine, Denmark’s $3.2 billion Bavarian Nordic, at least offers some clues as to what biotechnology investors are bracing for. The signals so far imply a relatively contained outbreak, but things could get worse.

The virus, which was first identified in 1958, has surged again this year after another relatively recent outbreak in 2022. With 27,000 cases and more than 1,100 deaths in the Democratic Republic of the Congo since the start of 2023, and a new strain detected this week in Sweden, the WHO has declared a global public health emergency. Pakistan's health ministry on Friday confirmed at least one case of the mpox virus in a patient who had returned from a Gulf country.

The closest thing to a market signal for how bad things could get is the share price of Copenhagen-based Bavarian Nordic, run by Paul Chaplin and whose Jynneos vaccine is effective against mpox. Investors have bid up the company’s value by about $1 billion over the past week. A higher value for the company implies more demand for vaccines, and therefore a worse outbreak.

Using its 23 times forward price-earnings multiple from Monday, based on LSEG Datastream figures, the value boost is equivalent to about $46 million of additional annual earnings, or $340 million in revenue using the 13% net margin that analysts are pencilling in for next year.

Since the U.S. government buys Jynneos at about $70 per shot, the implied additional doses from this week’s market value rise is about 5 million. That’s a lot, but not compared to the global population of the most at-risk patients, which includes children and those with underlying health issues. The company has said that it stands ready to make 10 million doses by the end of 2025. In theory, far more could be needed if governments decided to stockpile vast quantities of vaccines, as the United States does for smallpox.

It’s possible to imagine how something like that might happen. Mpox is mutating, and the recent increase in global travel may lead to more deadly strains than in 2022, when the virus last surged. Spending on global travel is expected to reach $8.6 trillion in 2024, a full recovery from the dramatic decline of 2020, McKinsey reckons. If mutations, like the one found in Sweden, result in more rapidly spreading deadly diseases, governments might impose travel restrictions. Investors’ relative calm would then be proved wrong.

Updated 17:54 IST, August 17th 2024