Published 11:56 IST, August 5th 2024

China’s luxury push paves way for sin tax rejig

Higher sin taxes will jeopardise already-weak sales for luxury powerhouses including the $340 billion LVMH and Cartier-owner Richemont.

- Opinion

- 2 min read

Taxing problem. China's latest plan to boost spending looks underwhelming. The State Council on Sunday released a 20-point plan aimed at spurring consumption in high-end sectors like yachts and cruise ships. Yet for cash-strapped local governments, the promise of higher fiscal revenue from taxing luxury goods and services will act as a powerful incentive.

The Chinese cabinet's latest announcement follows an earlier directive that called for higher wages to cajole low- and middle-income groups to save less. This time, Beijing wants to "create consumption scenarios" in a list spanning low altitude flying vehicles to snow sports. Some are reminiscent of the conspicuous spending Beijing once discouraged. Yet, amid a property crash and slowing growth, the Communist Party is having a rethink.

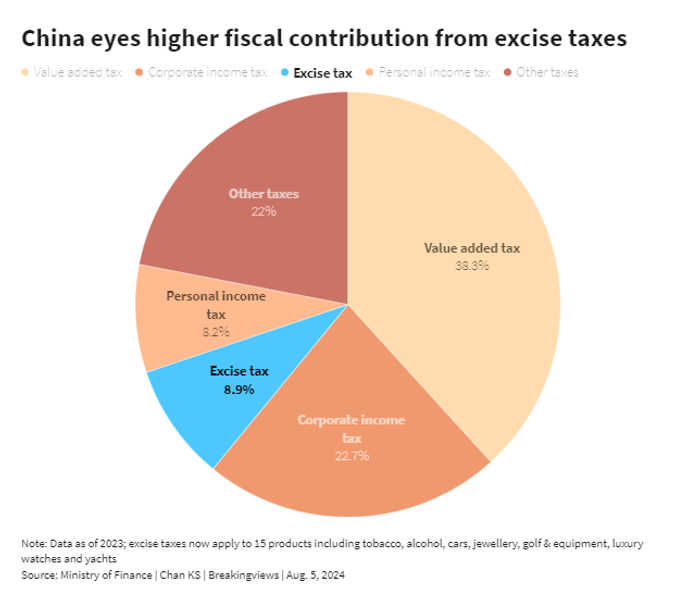

There may be a more practical goal: extracting more taxes from the wealthy. Excise levies on 15 products including tobacco, cosmetics, and yachts brought in 1.6 trillion yuan ($220 billion) in tax income last year, just under 9% of total fiscal revenue. Beijing imposed this consumption tax in 1994 and still keeps all of the proceeds today.

Expanding and sharing that windfall will be the next step in Beijing's tax reform. Local governments account for 80% of fiscal expenditures, but receive less than 40% of revenue, according to data from the Ministry of Finance. Officials have already flagged that consumption taxes may be applied to more items like luxury bags and private jets and, more importantly, distributed to local government coffers.

The reforms will be gradual: analysts at local brokerage Guotai Junan estimate additional excise taxes will be less than 200 billion yuan during the initial stage.

Even so, higher sin taxes will jeopardise already-weak sales for luxury powerhouses including the $340 billion LVMH and Cartier-owner Richemont. Moreover, Chinese officials will have to get creative in order to convince the rich to spend more despite higher taxes. Cities may lift restrictions on license plates for Porches and other luxury cars, for example, or try to develop new attractions like horse-racing, as authorities have in the Southern island of Hainan.

The risk is that this will lead to pipe dreams and, worse, even more wasteful spending. Hainan has spent years talking up its equestrian ambitions with little to show for it. Chinese officials have a daunting task ahead.

Updated 11:56 IST, August 5th 2024

Recommended

Top Voice

Exclusive Video

LIVE TV