Published 15:49 IST, January 9th 2025

Bain Buyout Fight Shows Allure Of Pensions

Two US private equity firms, CC Capital and Bain Capital, are vying for Australia's Insignia Financial.

- Opinion

- 2 min read

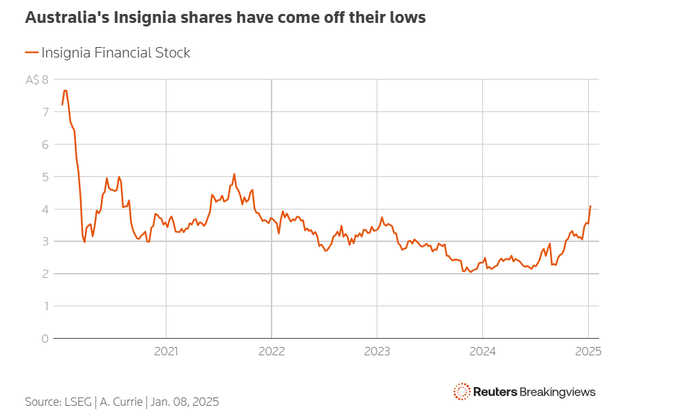

Super size. Australia's pension funds would surely be on any list of assets that investors would fight to own a piece of. Two U.S. private equity firms are now putting that theory into practice. On Monday CC Capital, founded by Blackstone veteran Chinh Chu, lobbed in a non-binding proposal valuing Insignia Financial's equity at A$2.9 billion ($1.8 billion). That's 7.5% higher than the already rejected offer Bain Capital put on the table last month, and a 40% premium to Insignia's undisturbed price. It shows the allure of Down Under's so-called superannuation industry.

Insignia is not the cream of the crop. Sure, the roughly $180 billion of superannuation assets it holds, accounting for around 70% of its revenue and all its earnings, rank it third behind AustralianSuper and Australian Retirement Trust.

But it's not growing. Outflows in the 12 months to the end of June 2024 were 2%, compared with net inflows of 7.2% and 3.7%, respectively, for its larger rivals. Most other major peers, like Hesta and Rest, are adding assets, too. The country's superannuation system held A$4.1 trillion at the end of June, 17% higher than a year earlier, making it the world's fourth-largest pool of retirement assets.

Part of Insignia's problem is that its superannuation business is a hodge-podge of offerings, partly the result of acquisitions. Boss Scott Harley has called them "a mess" and is cleaning them up as part of a broader turnaround that includes cutting group annual costs by some 20%, or A$200 million, by 2030.

Bain or CC Capital could try to speed those up and increase them. But the other problem impeding Insignia's superannuation growth is structural. It's a for-profit company in a business dominated by mutually owned rivals like AusSuper, ART and Hesta. Not having to hand over profit to external shareholders gives the latter a cost advantage; they also on average tend to have younger clients than Insignia and other for-profit peers like Mercer, which helps explain why they have more fee-generating money pouring in - and less heading out to fund pensions.

That would limit how much a successful bidder could bolster the top line. And more revenue would be needed to pay interest: a deal at CC Capital's proposed price would quadruple Insignia's net debt to 4 times this year's EBITDA, per LSEG data, assuming equity financed half the deal. It all warrants some bidding-war restraint.

Updated 15:49 IST, January 9th 2025