Published 09:02 IST, October 1st 2024

Saudi oil may keep a lid on Middle East fallout

Israel killed Hezbollah leader Sayyed Hassan Nasrallah in an airstrike on the group's central headquarters in the southern suburbs of Beirut.

- Industry

- 3 min read

Shock and awe. The war in the Middle East seems to be crossing red line after red line. Following attacks on top Hezbollah commanders in recent weeks, Israel on Saturday confirmed it had killed the Iran-backed group’s top leader Sayyed Hassan Nasrallah in a strike the previous day. In theory this should prompt an escalation from Tehran, but even so separate events in Saudi Arabia may limit the wider economic fallout.

Israel’s war in Gaza has certainly had savage economic consequences – year-on-year GDP in the Palestinian enclave fell 86% in January 2024, the World Bank says. But oil prices – the obvious way for the conflict to hit the global economy – have mostly hovered in the $70s and $80s a barrel region. Major hostilities on Israel’s northern border with Hezbollah were assumed to be the key reason to make them spike higher. The doomsday scenario would be for Iran to shut the Strait of Hormuz, through which a fifth of the global oil supply passes daily.

It’s not yet clear whether Israel will suffer a major riposte, either by Hezbollah unleashing more of its rockets on Israel or via direct attacks by Iran as seen in April. Israel’s onslaught may mean Hezbollah lacks the capacity to immediately respond, and Iran may not want to. Either way, a key player in what happens next is Saudi Crown Prince Mohammed bin Salman.

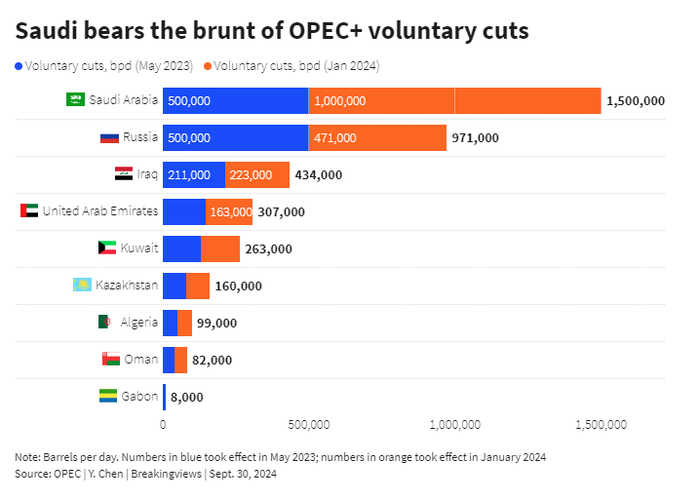

MbS is the leading light in the Organization of the Petroleum Exporting Countries, which along with allies like Russia controls around half of world supply and has for years been cutting production to prop up oil prices. Of late Saudi has been voluntarily pumping way below its maximum capacity of 12 million barrels per day, with production averaging just 9 million. That’s frustrating when OPEC members such as Iraq and Kazakhstan have been pumping above their own quotas, and when oil prices are far below where the Saudi budget breaks even.

Throw in sluggish oil demand via China’s economic downward spiral, plus rising non-OPEC competition from countries like Brazil and Guyana, and MbS’s patience is wearing thin. Saudi may ditch an unofficial price target of $100 a barrel, and raise output. OPEC could move to unwind some of the production cuts as soon as December.

It could be that MbS is merely signalling fellow OPEC members to pump what has been agreed. But oil traders know that being one of the lowest cost producers Saudi periodically just pumps what it can – it most recently did so in March 2020. Such a move would also find strong favour with U.S. politicians, who

Context News

The Israeli military said on Sept. 28 it had killed Hezbollah leader Sayyed Hassan Nasrallah in an airstrike on the group's central headquarters in the southern suburbs of Beirut a day earlier. Saudi Arabia is ready to ditch an unofficial price target of $100 a barrel and raise output, the Financial Times reported on Sept. 26. Sources also told Reuters that OPEC would move to unwind some of the production cuts as soon as December. Brent crude futures for November delivery rose 0.81% to $72.56 a barrel as of 0825 GMT on Sept. 30.

Updated 09:02 IST, October 1st 2024