Published 13:40 IST, November 2nd 2024

Oil glut renders industry’s appeal purely relative

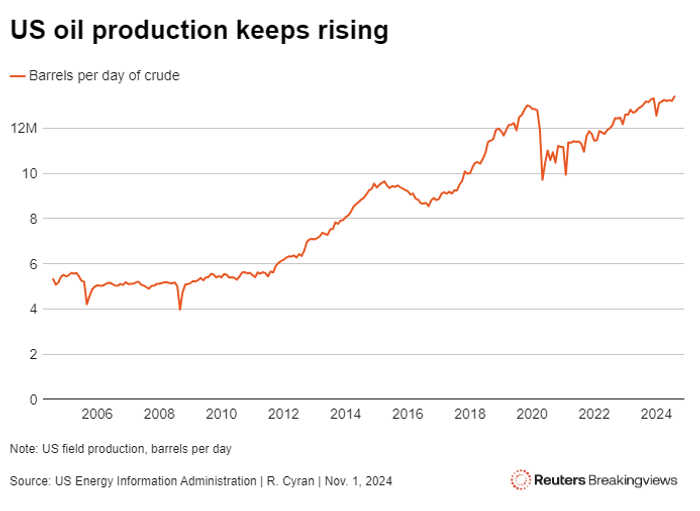

Most of the increase comes from beyond OPEC. US production exceeds 13 million barrels per day, and gaining, making it harder for the cartel to trigger a rise.

- Industry

- 3 min read

Barrel fever. When there’s excess oil, as is the case today, it’s easier to pick a winner. Exxon Mobil’s balance sheet and diversification make it appealing, but only on a relative basis. The abundance of crude suggests industry returns will only get weaker.

Exxon said on Friday it generated $8.6 billion of net profit in the third quarter, as production surged 25% from a year earlier. Much of it is attributable to the $60 billion acquisition of rival Pioneer Natural Resources. Falling commodity prices, however, translated into 5% less earnings. Rivals Chevron and ConocoPhillips suffered even worse declines, of 31% and 25% respectively, despite extracting more crude.

Gluts augur more of the same. The Organization of the Petroleum Exporting Countries and its allies are sitting on record spare capacity. Excluding Libya, Iran and Russia, they had more than 5 million barrels per day available within 90 days and which can be pumped for a sustained period, according to the International Energy Agency. It further estimates that worldwide demand will grow by no more than 1 million barrels per day in 2024 and 2025, while supply rises 1.5 million barrels per day in both years.

Most of the increase comes from beyond OPEC. U.S. production exceeds 13 million barrels per day, and gaining, making it harder for the cartel to trigger a rise in prices.

The bigger problem is waning growth in oil purchases. Electric vehicles will exceed 23% of new car sales this year, according to research outfit Rystad Energy, a proportion that promises to keep swelling. It helps explain why the IEA projects that supply capacity will exceed demand by 8 million barrels a day by 2030.

For energy-focused investors, Exxon is the safer option. Nearly a third of its income comes from chemicals, refining and other businesses. Moreover, net debt of about $15 billion is far outweighed by the $74 billion of forecast EBITDA this year, according to estimates gathered by LSEG. It also trades at 14 times estimated earnings, only a small premium to peers.

At the same time, Exxon’s 90% total shareholder return over the past decade – even with its generous dividends included – is less than half the roughly 240% from the S&P 500 Index. It’s a similar story for Chevron and Conoco. As the most recent financial results show, even companies sensibly managing capital and bracing for the energy transition will struggle when there’s too much oil. Better to drill for investment ideas elsewhere.

Context News

Exxon Mobil said on Nov. 1 it earned $8.6 billion in the third quarter, 5% less than in the same period a year earlier, while production increased 25% to 4.6 million oil equivalent barrels per day. Chevron said on Nov. 1 that it generated $4.5 billion of net profit in the three months ending Sept. 30, a 31% decline from the $6.5 billion a year earlier. Its production grew 7% from the previous year to 3.4 million oil equivalent barrels per day. Both companies said lower commodity prices hurt earnings. Chevron said the average price realized on a barrel of liquids was 12% lower than a year earlier.

Updated 13:40 IST, November 2nd 2024