Published 12:48 IST, October 23rd 2024

China-India ties will settle into a new normal

The days of Chinese companies breezily entering the South Asian country on their own, or snapping up large stakes in their regulated Indian peers seem gone.

- Economy

- 3 min read

Easy as she goes. Diplomatic ties between China and India are warming up fast. On Monday, the two countries reached a deal on how to patrol their disputed frontier, and on Wednesday, Xi Jinping and Narendra Modi will meet at the BRICS summit in Russia for the first time since 2020 when their forces clashed. New Delhi reacted then by sharply raising barriers to investment from the People's Republic. Photo opportunities aside, there is little chance of going back to the status quo of business ties four years ago.

New Delhi understands that technological expertise from the People’s Republic is essential to realising India’s manufacturing ambitions, including a target to produce electronics worth $500 billion by 2030.

The days of Chinese companies breezily entering the South Asian country on their own, or snapping up large stakes in their regulated Indian peers seem gone, however. Chinese-origin investment is likely to continue to be subject to close scrutiny and only welcome in cases involving a strong local partner as a majority owner or in a sector of strategic importance, such as electric vehicle batteries, Karam Daulet-Singh, Managing Partner of Touchstone Partners told Breakingviews.

Indeed, today's preference is to encourage Chinese-linked firms to form joint ventures with Indian tycoons; fast-fashion giant Shein’s partnership with Mukesh Ambani ’s Reliance Industries and SAIC’s tie-up with Sajjan Jindal’s JSW Group to sell its MG-branded cars in the South Asian nation are two examples. These leave the Indian tycoons firmly in the driving seat. In Shein's case, Reliance will run and fully own the operations and it will only pay a share of the profit to Shein. That will make it easier for Indian companies to manage any controversies if the two countries fall out again.

Though the terms of doing business in India for Chinese companies are settling into a new normal, China can still benefit. Its companies face slowing GDP growth in their domestic market, and some would gain from diversifying their manufacturing bases beyond China because politicians in the West want less exposure to supply chains in the world's second-largest economy.

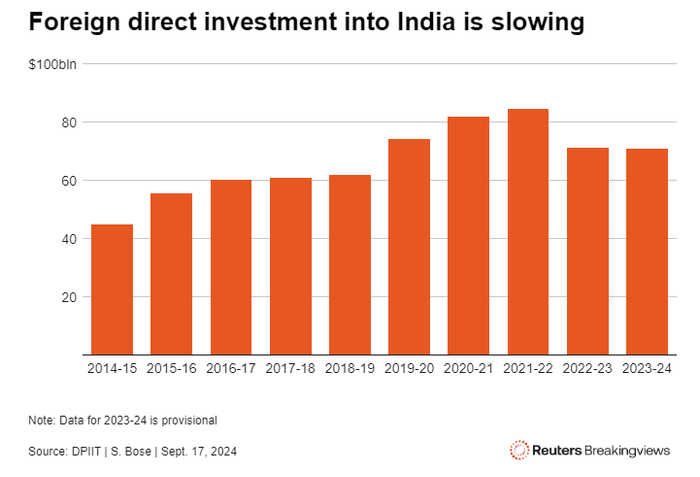

New Delhi has gradually nuanced its attitude towards doing business with China over the past four years. Not least as India experienced a fall in annual foreign direct investment over the same period. The diplomatic thaw between the two countries is more an affirmation of that new normal than return to the hey-days.

Context News

India and China have reached a deal on patrolling their disputed frontier to end a four-year military stand-off, the Indian Foreign Minister Subrahmanyam Jaishankar said on Oct. 21. "We have gone back to where the situation was in 2020", he said at a NDTV media conclave, adding that the disengagement process with China has been completed.

Updated 12:48 IST, October 23rd 2024