Published 15:14 IST, June 29th 2024

Wanted: A buffed-up board to put a sheen on Shein

Shein is preparing a bumper stock market listing in London.

- Companies

- 4 min read

Polish and Shein. Shein is preparing a bumper stock market listing in London. First, though, the fast-fashion giant needs to persuade a chairman and non-executive directors to join its board. Installing corporate heavyweights will be crucial to calming down fund managers jittery about Shein’s Chinese roots, its supply chain, and its contribution to fashion waste. Breakingviews imagines how a headhunter might approach a potential candidate.

Dear Ned,

I hope you don’t mind me getting in touch. I’m writing from Security Blanket LLP, a specialist recruitment firm for companies seeking to reassure investors by appointing board members with impeccable reputations. Your record as a director of large public companies could be a critical ingredient for my client Shein, which is planning an initial public offering in London that could value the company at 50 billion pounds ($63 billion).

Allow me to tell you a bit about Shein. It has built a global empire by selling fashion items via its highly compelling mobile app. I’m sure you’ve seen its logo on the hundreds of parcels that your daughter has delivered every week. Some people insist tops and bags costing $5 cannot be high quality. But as the company’s suppliers use only the finest fabrics and designs, I’m confident her “Shein haul” does not end up balled up in a corner of her bedroom or flung in the bin.

Our Executive Chairman Donald Tang’s past career with the robust investment bank Bear Stearns makes him a great candidate to lead the IPO. But some have argued that an independent chair might be even better. The retailer hopes your experience in the tobacco industry will help fund managers understand how this company can be a worthwhile addition to any investment portfolio, even those with the most exacting environmental, social and governance criteria.

Speaking of governance, you will doubtless be eager to meet your potential board colleagues. Given the company’s highly private nature, however, I’m sure you understand that we cannot share any information about other directors or investors. The same goes for financial minutiae like annual sales and profit margins. But rest assured, once Shein goes public its stellar standards of disclosure will get even better.

Your extensive background working in China is another asset. You will be well-placed to explain how a company founded in Nanjing but now incorporated in Singapore is not remotely Chinese. True, Shein proudly sells products manufactured by entrepreneurial factories in the People’s Republic, but then so does Apple. Incidentally, the company would be happy to offer you a guided tour of any of these facilities and arrange meetings with their happy and well-paid workers. All we need is three months’ advance notice in writing.

If you do visit China, you may also want to drop by the China Securities Regulatory Commission which must sign off Shein’s plan to sell shares in London. Don’t dwell on the company deciding against listing in New York, the home of its largest market, or indeed U.S. lawmaker Marco Rubio’s nitpicking about “slave labour and sweat shops”. Just think of it as another interesting quirk for a fast-growing global business.

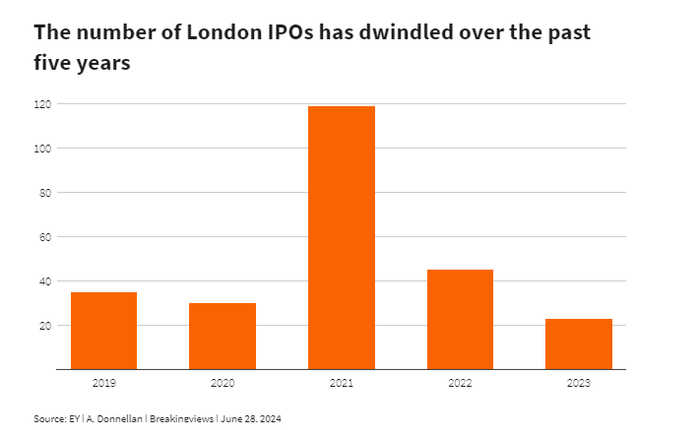

Indeed, taking this role would be akin to performing a national service. Sure, UK lawmakers have been carping about factory working conditions and Amnesty International has even dared to call a Shein listing a “badge of shame” for the City of London. But a successful IPO will put London back on the map for high-profile stock market listings. British politicians and regulators will do almost anything to make it happen and have been clear this is a core objective. London’s new, user-friendly listing rules also allow for fun innovations like a smaller free float and extra voting rights for insiders. That will make it easier to ignore local naysayers.

Shein has done its homework and understands the importance of a credible board. You could provide the same heft that former BP boss Tony Hayward brought to Genel Energy, the Kurdish oil exporter, and enjoy the same once-in-a-career experiences that former UK minister Greg Barker encountered as chairman of EN+, the Russian metals group. I’m sure both these men would be happy to welcome you to one of their homes to explain their motivations.

I must warn you there is stiff competition for this role. We have already approached former UK finance minister Sajid Javid and Rona Fairhead, previously chairman of the BBC Trust. Many of the candidates we approached when Saudi Aramco was considering a London listing are also keen. However, your involvement would provide an extra shine to Shein.

I hope you will consider this great opportunity and will shortly be in touch with your office to schedule a face-to-face meeting. Rest assured that all correspondence will, of course, be handled in exactly the same way Shein has started the listing process with Britain’s markets regulator: confidentially.

Sincerely,

Felicity Comfort

Updated 15:14 IST, June 29th 2024