Published 20:38 IST, August 26th 2024

Intel will be forced to find a plan B

Once the semiconductor industry’s undisputed leader, Intel now lags TSMC in terms of chip density, cost and power efficiency

- Technology

- 3 min read

Outmatched. Intel’s in a money-spending fight, and it’s falling short. The company has plowed billions into matching Taiwan Semiconductor Manufacturing prowess in producing cutting-edge chips. Yet with business slowing, boss Pat Gelsinger has far less firepower. Intel simply can’t keep up.

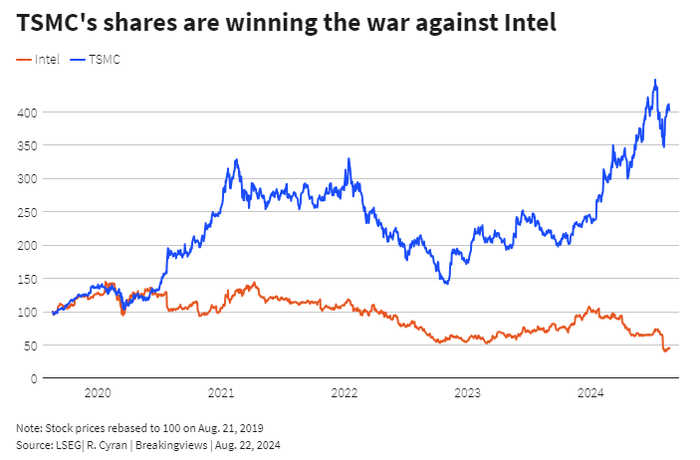

Once the semiconductor industry’s undisputed leader, Intel now lags TSMC in terms of chip density, cost and power efficiency. As rivals abandoned the vertically integrated design-and-manufacturing model, they benefitted from the Taiwanese firm’s advances, gobbling up market share. The result: Intel is burning cash, and its stock has fallen by half in five years.

Gelsinger was the chief architect of Intel’s landmark 80486 chip nearly four decades ago, and returned to pull the company out of its technological rut in 2021. He now says that the mission is nearly accomplished, promising that chips coming next year will equal anything made by TSMC on key measures. Perhaps, but that’s only part of the battle. Intel needs to prove it can produce cutting-edge chips in volume, efficiently, and that it can coax external customers to use its manufacturing.

Scaling up production like this - and upgrading it year after year - is immensely costly. TSMC plans to invest $30 billion in 2024. About 80% of this goes to the most advanced semiconductors. That’s about enough for a single new fabrication facility, which costs $25 billion, according to Intel.

The U.S. company doesn’t have to invest quite as much. Executives say that public subsidies and help from co-investors, such as Brookfield, can fill in a quarter of required spending. If so, Intel needs about $19 billion annually just to maintain the same one-new-plant-a-year pace.

Right now, it plans to spend roughly that amount next year. Problem is, Gelsinger has also promised that capital expenditures will equal about a quarter of revenue in the long term. If sales come in at about $75 billion, that leaves enough headroom. But that’s fully a third more than analysts see Intel generating next year, according to LSEG.

Meanwhile, the cost of building plants is only going up. TSMC has fatter operating margins than Intel, and its capital expenditure has averaged 40% of revenue over the past decade. In other words, the two companies are going in opposite directions. Intel has staked its turnaround on two revivals: one in its chip designs, and the other in regaining manufacturing supremacy. If current promises pan out, it will have proven its nous in the former. But with the financial gap only widening, barring a miraculous turnaround, Gelsinger will be forced to rethink the latter.

Updated 20:38 IST, August 26th 2024