Published 16:25 IST, August 20th 2024

AMD’s $5 bln deal solidifies AI runner-up status

AMD said on Aug. 19 it had agreed to buy ZT Systems in a cash-and-stock deal valued at $4.9 billion, including a contingent payment of up to $400 million.

- Technology

- 3 min read

Winner takes most. Advanced Micro Devices' latest acquisition solidifies the chipmaker’s distant silver-medal status in the artificial intelligence race. The $250 billion company’s data center business is booming, thanks to demand for training and running AI systems. Absorbing privately held ZT Systems for $5 billion in cash and stock should help AMD’s customers buy and deploy its chips faster – but still leaves rival Nvidia miles ahead.

The company run by CEO Lisa Su was once known for playing second fiddle to Intel in producing processors for personal computers, but now it’s more recognizable as the runner up to Nvidia in making chips for data centers. Analysts estimate revenue from AMD’s unit serving that market will double this year to $12.8 billion, accounting for half the company’s top line.

Systems used to train AI are becoming rapidly bigger. Having all these chips work together means data centers are becoming rapidly more complex. Here’s where ZT Systems fits in. Its 1,000 engineers can help design servers for firms like Dell Technologies and optimize versions for companies building large cloud computing services. This should speed up the deployment, which is useful in the ongoing AI gold rush.

AMD does not want to compete with customers who are building servers using AMD chips, so it will offload its new subsidiary’s manufacturing capacity. ZT Systems’ annual sales are about $10 billion, Su told Reuters in an interview, making the purchase price of around half that sum look modest. Rival server producer Super Micro Computer is valued at 1.2 times its estimated revenue over the next 12 months, according to LSEG data.

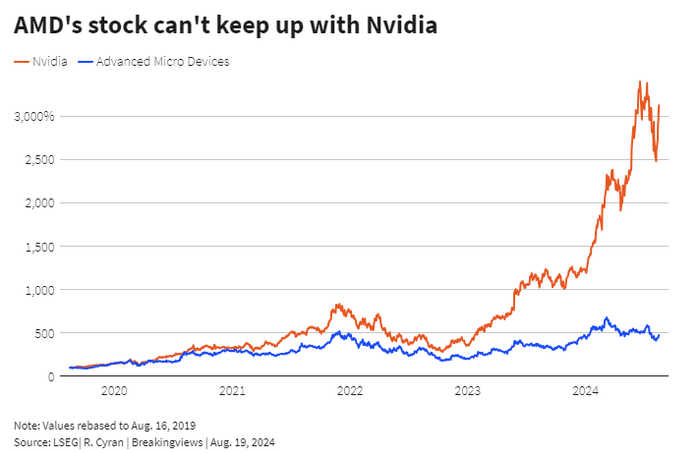

Yet while AMD’s stock has outperformed the S&P 500 Index over the past five years, Nvidia has left it far behind in terms of shareholder returns and nearly every other metric.

The $3 trillion giant’s package of offerings for building data centers is bigger and its software is the default standard for AI developers. Nvidia’s data center business is projected to grow slightly faster than AMD’s this year, while the unit’s projected revenue of $106 billion is about an order of magnitude larger. Economies of scale also ensure that Nvidia’s overall operating margin is more than double that of its nearest competitor. This gives Nvidia CEO Jensen Huang the firepower to hire the best engineers, pay premiums in bidding wars, and invest more in research and development.

The only metric where AMD keeps up is in the valuation of its stock. Its shares trade on 32 times estimated earnings over the next year, a mere 10% discount to Nvidia’s multiple.

That’s too small a gap for such a distant runner up.

Context News

AMD said on Aug. 19 it had agreed to buy ZT Systems in a cash-and-stock deal valued at $4.9 billion, including a contingent payment of up to $400 million based on achieving certain post-closing milestones. ZT Systems is a privately held company based in New Jersey that designs and makes servers and other data center equipment. The company has roughly $10 billion of annual revenue. AMD plans to keep ZT Systems’ design operations but sell the company’s server manufacturing unit once the deal closes. AMD shares were up 3% at $153 by midday in New York on Aug. 19.

Updated 16:25 IST, August 20th 2024