Published 12:21 IST, August 7th 2024

Warren Buffett sagely ignores his own advice

The logic of the Nebraska billionaire’s aversion to excess cash is hard to dispute.

- Opinion

- 2 min read

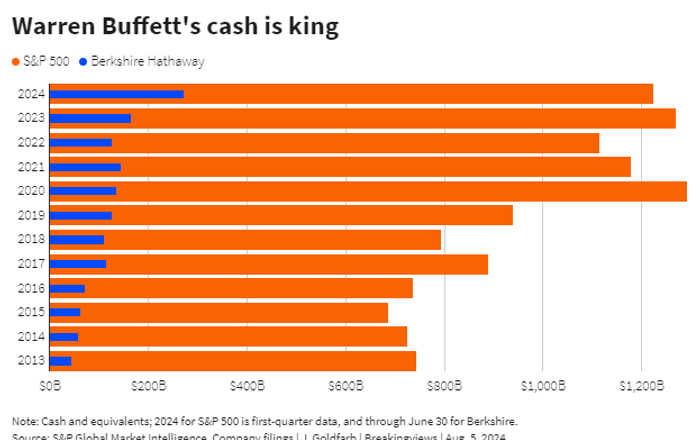

Cash memory. Warren Buffett has dropped so much investment wisdom over the past six decades, it would be amazing if even he could keep it all straight. For example, he has scoffed at the idea that cash is king. And yet his conglomerate Berkshire Hathaway now sits on a war chest bulging with some $275 billion of it. It should be helpful as stock markets wobble.

The logic of the Nebraska billionaire’s aversion to excess cash is hard to dispute. It’s “always a bad investment,” he

Of course, the funds won’t be entirely unproductive. With borrowing costs higher, they can generate more than $1 billion a month for Berkshire and its shareholders by being loaned, virtually risk-free, to the U.S. government. To Buffett’s point, however, in the eight years since Berkshire first invested in Apple in early 2016, the iPhone maker’s share price has more than octupled even as it paid out tens of billions of dollars in dividends.

It’s unclear whether Buffett feels overexposed to Apple, sees a better place to deploy the money or is more broadly worried about stocks in general. Either way, his cash towers over the hoards at non-financial S&P 500 companies, which amounted to $1.2 trillion in the first quarter, according to S&P Global Market Intelligence. For those that have reported second-quarter results, Amazon.com’s $71 billion is a distant second to Berkshire. Collectively, private equity funds have roughly $4 trillion of capital to spend, consultancy Bain estimates.

Opportunity could be on its way. Investors anticipate wild swings in valuations, evidenced by the sharp jump in the CBOE Market Volatility Index and the recent ructions in equities worldwide. Economists are increasingly fearful of a slowdown in consumer spending and a possible U.S. recession over the next year. And the forward 12-month ratio of price to earnings for the S&P 500 Index, at almost 21 times, has been trading higher than the 10-year average of about 18 times, according to FactSet. Buffett may be violating his own cash hoarding principles, but he rarely forgets the importance of when to get greedy.

Updated 12:21 IST, August 7th 2024