Published 12:55 IST, July 17th 2024

Trump lays bare TSMC’s inherent vulnerabilities

Trump's comments mark a potential departure from the current administration's support for Taiwan.

Achilles' heel. Taiwan Semiconductor Manufacturing may be one of the most dominant technology companies in the world, but it is also the most vulnerable.

In an interview published on Tuesday, U.S. presidential candidate Donald Trump said Taiwan took America's chip business and complained about the island's chipmakers taking subsidies to build new factories stateside. He wants Taipei to pay the U.S. for its defence too. For the island's $840 billion semiconductor giant, it's a brutal reminder of how Washington and Beijing can overshadow its fortunes.

Trump's comments mark a potential departure from the current administration's support for Taiwan, which China claims sovereignty over. Taipei counts Washington as its most important ally and arms supplier; President Joe Biden has even said he does not rule out using U.S. military force in the event of a Chinese invasion. Trump's blunt criticism that Taiwan does not give the U.S. anything and should buy protection comes at a delicate time. Since Taiwanese President Lai Ching-te, who Beijing sees as a separatist, took office in May, China has been ratcheting up pressure including sending near-daily air force missions close to island.

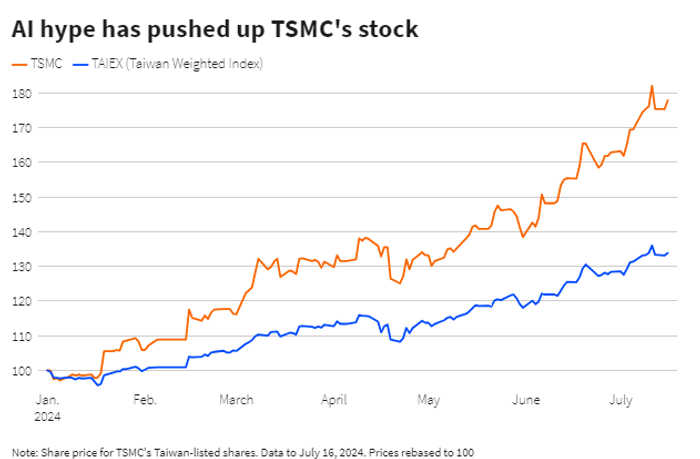

No wonder investors promptly wiped $23 billion off TSMC's market value, or nearly 3%, on Wednesday morning. True, that pales against the stock's surge by over three-quarters since the start of the year thanks to TSMC's dominance in making cutting-edge chips. But it spotlights a growing concern that the worsening Sino-American relationship is holding back the shares at a time when those of peers are enjoying a bigger artificial intelligence-related boom.

Analysts at Fubon Research estimate the company's AI revenue, including from manufacturing and packaging chips for Nvidia, will more than quadruple to $21 billion by 2025, making up a fifth of TSMC's top line. But even after this year's rally, TSMC trades at a multiple of less than 24 times its 12-month forecast earnings, up to one quarter lower than the multiple of the SOX semiconductor index comprised of 30 major chip companies, per Bernstein. And while TSMC's American Depositary Receipts rose to a record high this month, briefly surpassing $1 trillion in market capitalisation, its Taiwan-traded shares didn't hit the same mark.

Even if some of the former president's comments can be discounted as pre-election rhetoric, the reiteration of his enthusiasm for using tariffs and resentment for handing out subsidies ought to unnerve C.C. Wei. The TSMC boss is spearheading an ambitious global expansion, including building three factories in the United States to take advantage of the $6.6 billion in subsidies on offer to the company from Washington. Trump is adding considerably to uncertainty about TSMC's place in the world.

Updated 12:55 IST, July 17th 2024