Published 14:58 IST, July 13th 2024

Now is least-bad time for JPMorgan CEO to move on

JPMorgan on Friday reported the highest quarterly earnings of any bank in history.

- Opinion

- 2 min read

Out of office. Jamie Dimon missed JPMorgan’s quarterly earnings call on Friday because he was traveling. That’s unusual: neither throat cancer nor an aortic dissection have stopped him before. However innocuous, his absence makes for a good dress rehearsal. This could be the least-bad time for the long-serving CEO of the near-$600 billion lender to initiate his exit.

JPMorgan on Friday reported the highest quarterly earnings of any bank in history. The $18 billion sum was boosted by a $6 billion gain on shares held in payments processor Visa, but even without that, Dimon’s bank is serving high profit and low anxiety. Losses on credit cards stand at a roughly normal 3.5% of total outstanding borrowings. The bank’s common equity capital buffer is about $56 billion larger than regulators demand, giving ample room for dividends and buybacks.

This smooth road makes it easier for Dimon, now 18 years into his tenure, to name a successor. The two likeliest candidates, Marianne Lake and Jennifer Piepszak, both run well-performing divisions. Lake’s consumer bank made a return on equity of 30% in the quarter; Piepszak’s investment bank generated fee growth of over 50%. Rivals Citigroup and Wells Fargo also reported strong gains in dealmaking, suggesting the beginning of a broad bounce-back. Completed M&A is typically around 20% of GDP, according to Morgan Stanley analysts; in 2024’s first quarter, it ran at a rate of around 8%.

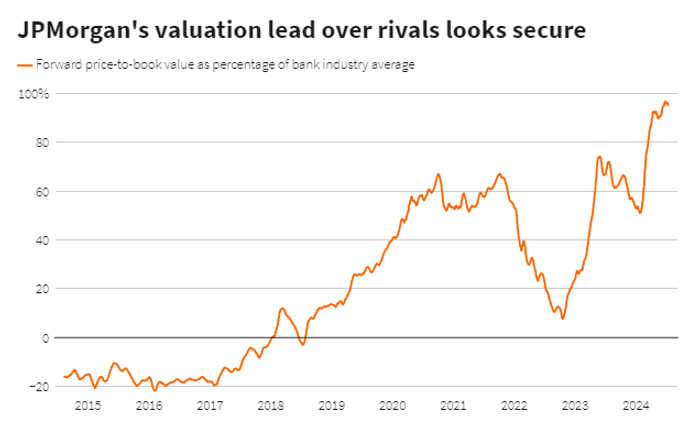

Dimon’s steady hand against this benign backdrop means his bank trades at 1.8 times forward book value, according to LSEG data, almost double the valuation of the banking industry overall. And the one big outstanding threat to the industry, the onerous retooling of Basel 3 capital rules, has been all but neutered.

While JPMorgan may be a bastion of stability, though, Dimon - who leans Democrat - has expressed concern about the state of the country. U.S. President Joe Biden’s weakness after a poor debate performance makes the people in his orbit all the more crucial, whether it’s a future Treasury Secretary or other senior economic advisory jobs. Dimon doesn’t want to run for president, but he clearly wants whoever does to be effective. That must increase the lure of a move to Washington.

There seems no rush, from investors or the board, for Dimon to leave JPMorgan. Left-leaning Democrats may not want him. But if the stars align, the cost of an orderly transition at the bank is as low as it’s ever been.

Updated 14:58 IST, July 13th 2024