Published 12:27 IST, August 2nd 2024

Meta joins corporate ‘profit-to-fines’ club

The $1.2 trillion Facebook parent grew revenue 22% year-over-year in the second quarter to $39 billion, almost twice the rate of Alphabet.

- Opinion

- 3 min read

Metastasizing. Meta Platforms might seem in a position of unassailable strength. The $1.2 trillion Facebook parent grew revenue 22% year-over-year in the second quarter to $39 billion, almost twice the rate of top-line expansion at Alphabet. The result, though, is driven more by monetization of its users than adding new ones. There’s more than one way that success can be punctured.

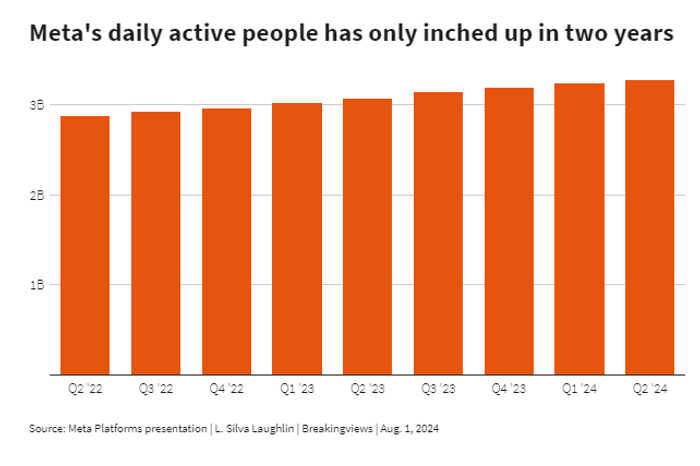

Growth in two metrics key to the enduring stamina of a social network - engaged users and ad impressions – slowed in the three months ended June. Daily active people across its platforms including Facebook and Instagram were about flat compared to the prior quarter. Growth in ad impressions slowed to a third of the rate clocked up last year. But the average price per ad increased 10%, while operating margin improved 9 percentage points to 38%. Net income, consequently, jumped 73% to more than $13 billion.

Keeping the machine of ever-improving ad targeting whirring requires far-reaching data collection. Regulators, though, are on a hair trigger to impose penalties for perceived over-stepping. This week, Meta agreed to pay the state of Texas $1.4 billion to settle accusations of illegally using facial-recognition technology but denied wrongdoing. Last week, Reuters reported it might have to shell out $13 billion after the European Commission charged it with unfair advertising practices. Meta last year paid 1.2 billion euros for violating European Union privacy laws. In 2019, the U.S. Federal Trade Commission imposed a record $5 billion fine over claims of misused data.

As Meta gets ever-larger, that might not seem like such a big deal: Profit in 2024 and 2025 should top $110 billion, combined, according to LSEG estimates, easily absorbing the levies. Other sharp-elbowed industries attract similar penalties - banking giant Goldman Sachs has been forced into payouts ranging into the billions.

But backlash can be compounding, and enforcers are now bearing down on boss Mark Zuckerberg from multiple angles. Among them, the Wall Street Journal has reported that ads on Meta’s platforms helped steer people to sellers of illegal drugs, while federal authorities are investigating the company’s role in the sale of narcotics. In a statement to Breakingviews, Meta said its business is “strong because advertisers use our services to grow and thrive." A spokesperson added “We have strict rules about the type of content that can be advertised on our platforms, and we reject hundreds of thousands of ads for violating our policies.” Sooner or later, though, investors might give the profit-to-fines loop a thumbs down.

Updated 12:27 IST, August 2nd 2024