Published 16:26 IST, July 29th 2024

Japan’s auto rally betrays global EV anxiety

For Mitsubishi, the minnow of the alliance, boss Takao Kato has the most to gain from linking up with larger rivals.

- Opinion

- 3 min read

Me three. Japan's latest stock rally underscores the global anxiety over automakers' transition to smarter, cleaner cars.

Investors on Monday were quick to react to the news that Mitsubishi Motors will join an alliance between Honda Motor and Nissan Motor, which the Nikkei had reported a day earlier, citing sources. The $4 billion carmaker's shares rose some 5% following the report, while its larger peers each gained more than 2%, adding nearly $2 billion to their combined market valuation.

Details about how exactly the trio would work together are scant. Though Nissan and Honda announced they were looking into a strategic partnership back in March, little is known about the content of their talks, except that they were wide-ranging, covering automotive software platforms, core components related to electric cars, and the even vaguer category “complementary products”.

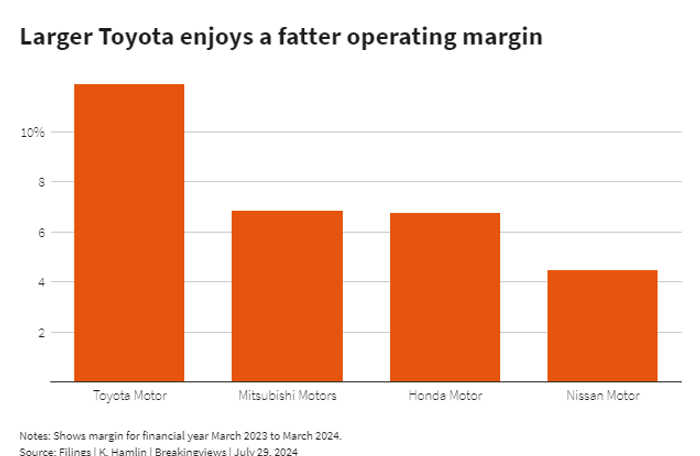

Even so, there is reason to be excited. Combined sales of the three manufacturers totalled nearly 8 million units last year. That indicates scope for significant economies of scale in the research, development and sourcing of key technology, which could be especially lucrative for costly components like batteries. By comparison, the world’s largest group by sales, compatriot Toyota Motor, delivered just over 11 million vehicles in the 12 months to the end of March. Operating margins at the $250 billion giant hit 11% in its most recent financial year, per LSEG, trouncing roughly 7% at Honda and Mitsubishi and 4.5% at Nissan.

For Mitsubishi, the minnow of the alliance, boss Takao Kato has the most to gain from linking up with larger rivals. The company, which sold fewer than 1 million cars in the last fiscal year, is part of another three-way tie-up with Nissan and Renault. Yet in the quarter ending June, earnings slumped 38% year-on-year to 29.5 billion yen, about $200 million, on the back of falling volumes, rising sales expenses and other costs. And although the manufacturer claims to have launched the world’s first ever mass-market electric vehicle when it introduced the i-MiEV in 2009, it has since fallen behind. Last year’s strategy reset revealed EVs and hybrids made up just 7% of its sales in 2021, a number it wants to boost to 50% by 2030.

Mitsubishi's woes are not unique. Earlier this month, global brands spanning Nissan, Stellantis and Hyundai Motor flagged concerns over rising marketing costs and sluggish demand, which are squeezing the bottom line just as they look to pour more capital into developing smarter, cleaner cars. Investors' eagerness to seize on any opportunity for companies to cut costs, however fuzzy and pre-mature, betrays the industry's profit angst.

Updated 16:26 IST, July 29th 2024