Published 10:18 IST, September 24th 2024

Intel’s tempting discount is less-than-solid state

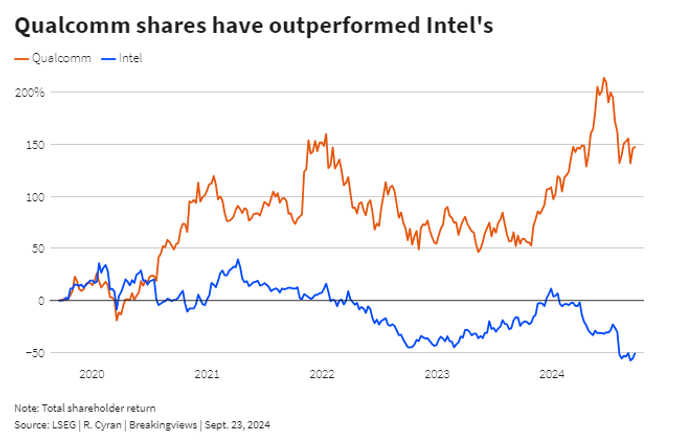

Intel is losing share to AMD and PC newcomers like Qualcomm. Its revenue is essentially flat from a decade ago; AMD’s has quadrupled.

- Opinion

- 3 min read

Some of the parts. Intel’s meltdown has opportunistic onlookers salivating. The once-leading U.S. chipmaker’s shares are down by half this year. Now, rival Qualcomm is mulling a bid for the whole firm, according to Reuters. Buyout shop Apollo Global Management, meanwhile, is offering to invest up to $5 billion according to Bloomberg. Thing is, this isn’t the screaming deal it might seem.

Intel does have valuable pieces. Specialized chip unit Altera, on a 20% discount to faster-growing Lattice Semiconductor’s multiple of 9.5 times revenue, might be worth $15 billion. A stake in self-driving auto firm Mobileye Global is worth around $8 billion.

Intel’s crown jewel of designing chips for PCs and data centers, meanwhile, is expected to generate nearly $50 billion of revenue over the next four quarters, according to LSEG data. On rival AMD’s roughly 8 times sales multiple, that would be worth $390 billion. Even with some $20 billion of net debt, that’s over three times Intel’s current valuation.

But this ignores the elephant in the clean room. Intel is losing share to AMD and PC newcomers like Qualcomm. Its revenue is essentially flat from a decade ago; AMD’s has quadrupled. Put simply, the business deserves a substantially lower valuation.

Moreover, unlike Qualcomm or AMD, Intel is also a manufacturer. Those operations are a money pit, generating $4.2 billion of revenue last quarter but losing $2.8 billion. Intel’s head-to-head competition against the much-larger Taiwan Semiconductor Manufacturing ensures it must shovel ever-more money into the business. That makes valuing it near-impossible: sure, TSMC’s market capitalization stands at nearly $800 billion, but it sported a 37% net income margin last quarter.

Worse, the U.S. government has made these operations a cornerstone of its chip strategy, awarding Intel billions in subsidies. Regulators will carefully guard these operations, before even considering the antitrust problem posed by Intel and Qualcomm’s combined might.

Other watchdogs matter, too. Intel does business in China, where enforcers have killed deals by both the company led by Pat Gelsinger and its potential suitor. Antitrust pushback effectively snuffed out Qualcomm's bid for NXP Semiconductors in 2018, and Intel's acquisition of Tower Semiconductor last year.

Of course, Intel could definitely use cash. Apollo could capitalize, as it did when it invested in a $900 million slug of preferred equity issued by Western Digital, or $1.25 billion of secured notes from chipmaker Wolfspeed. Both promised roughly 10% yields at minimum. Whether Intel can bear those costs is a matter for negotiation; adding equity in to juice returns might not offer the upside a naive sum-of-the-parts implies. Intel is cheap - but deservedly so.

Updated 10:18 IST, September 24th 2024