Published 07:14 IST, September 18th 2024

Intel forges path to probable capital incineration

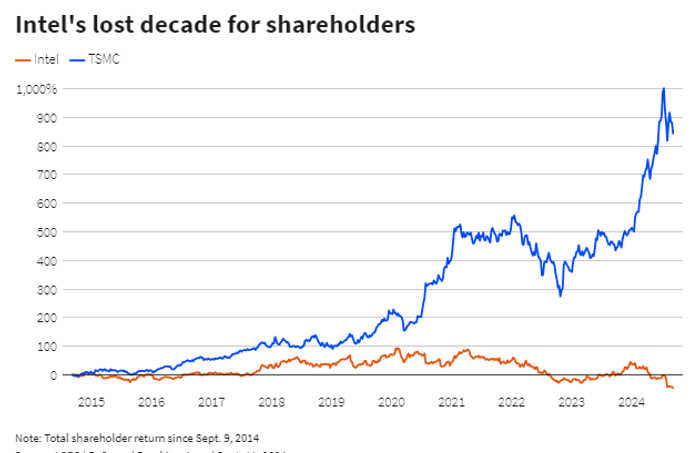

The $90 billion company lost its technological footing when Taiwanese chipmaker TSMC started making chips that were more power efficient, cheaper, and denser.

- Opinion

- 2 min read

Treasure or sunk cost. Intel is a chipmaker, just not one of the exciting ones. Boss Pat Gelsinger is trying desperately to change that: on Monday he said Amazon.com’s Web Services division had agreed to buy billions of chips made by Intel, sending its shares up 7%. That decision, along with other plans that could free up capital for investment, could add 40% of value to the company’s stock price. Snag is, there are too many ways in which Intel could still incinerate cash.

The $90 billion company lost its technological footing when Taiwanese chipmaker TSMC started making chips that were more power efficient, cheaper, and denser. An attempt to regain ground has been costly. In August, Gelsinger suspended its dividend and cut staff. It’s possible that Intel will try to sell assets next, including part of Altera, which makes programmable chips, and the company’s stake in Mobileye Global.

Both those deals could streamline Intel and bring in capital. Altera has $2 billion of annual revenue. At a 20% discount to rival Lattice Semiconductor’s enterprise value-to-sales multiple of 9.5 times, it would be worth $15 billion. Meantime selling Mobileye could raise $7 billion, assuming a 15% discount to the share price.

This cash, plus the guiding hand of Amazon, could help give Intel a fighting chance against TSMC. A cutting-edge semiconductor plant costs over $20 billion to build and can remain in production for 20 years. If Intel uses some of its cash from asset sales to build a plant and squeezes out a quarter for every $1, roughly the same return TSMC gleans, it would be worth an additional $35 billion to Intel’s market capitalization at a 7% discount rate, Breakingviews calculates.

Yet that sort of turnaround is much easier on paper than in reality. TSMC’s revenue is about 5 times as large as Intel's. Intel may have to offer discounts to gain market share and new factories often face teething problems. Plus incumbents have a huge advantage, not least because TSMC’s profit-making business has superior resources to fight off Intel. Without much bigger muscle, Intel’s gambit may become a sunk cost.

Updated 07:14 IST, September 18th 2024