Published 07:50 IST, September 19th 2024

Data decline blurs Fed’s soft-landing vision

The Census Bureau and Bureau of Labor Statistics measure the official unemployment rate using a survey that randomly samples 60,000 households.

- Opinion

- 3 min read

Muddy waters. Throughout its current battle against inflation, the U.S. Federal Reserve’s mantra has been “data-dependency.” Chair Jerome Powell has vowed the central bank will not be swayed by individual employment or inflation reports and will instead rely on a preponderance of data. That’s wise, but also necessary: the most important economic information collected by U.S. statistical agencies is becoming less reliable.

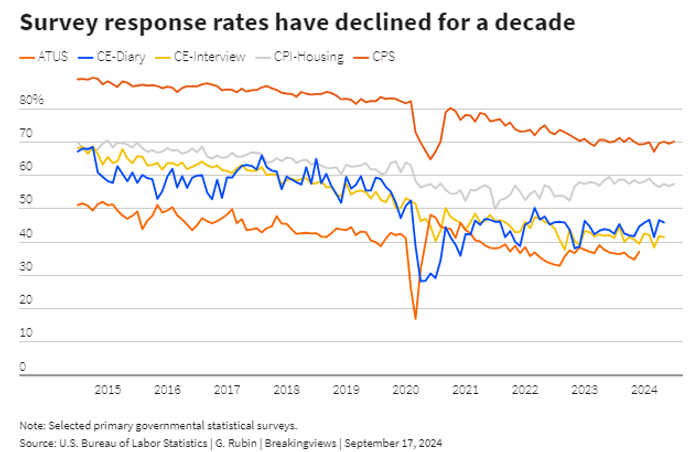

Number-crunchers are grappling with plummeting response rates for some crucial measurements. The Census Bureau and Bureau of Labor Statistics, for example, measure the official unemployment rate using a survey that randomly samples 60,000 households meant to approximate the overall American population. But the number of participants responding to the survey has dropped from 90% to 70% in the past decade.

Indeed, response rates for government surveys have plummeted across the board, with few surpassing the 80% threshold that in the past served as a quality marker. The leading group of American statisticians warned this summer that while current surveys still produce good data, the risks of further erosion are high and troubling. Survey response rates are declining everywhere: statisticians attribute the decline to respondents being bombarded with survey requests and the advent of tools to avoid them, like caller ID.

The unemployment measure could get more inaccurate before it gets better. Due to a drop in inflation-adjusted funding for statistical agencies, the survey is set to trim its sample size to 55,000 from 60,000 in October. That should not have meaningful effects on overall data quality for now, but makes it harder to track changes in subgroups, like different ethnic or age demographics.

The decline in response rates, which was exacerbated by the pandemic, has led to large data revisions that can fundamentally change how policymakers and investors look at the economy. Fewer participants can skew the picture and require revisions once larger data sets, such as tax receipts, become available. By then, it’s too late to make real-time decisions. The Labor Department last month released a new estimate of job growth for the 12 months ending in March that calculated the U.S. added 178,000 jobs a month over that period, down from the prior estimate of 246,000 jobs a month.

As the Fed prepares to start cutting rates this week, it needs an accurate view of the labor market. Unclear signals could lead rate-setters to flub the soft landing they have in their sights. Even so, there’s plenty policymakers and investors can do to construct a broader picture of the economy. The central bank looks at employment data from jobs sites like Indeed and real-time indicators of consumer activity, from restaurant reservations to airport security screenings. The problem isn’t the amount of data available, but creating a holistic picture that accurately reflects current conditions. Otherwise, public and private entities risk flying blind.

Updated 07:50 IST, September 19th 2024