Published 10:22 IST, September 18th 2024

Commerzbank’s UniCredit defences are built on sand

Orcel’s stake-building, seemingly executed under the nose of German Chancellor Olaf Scholz, has prompted domestic unease.

- Opinion

- 3 min read

Flimsy shield. Commerzbank is manning the barricades. The $20 billion German lender is in the sights of Andrea Orcel, CEO of $67 billion Italian rival UniCredit, who last week announced he had snapped up a 9% stake in double-quick time. While his gambit has ruffled some Teutonic feathers, it’s not clear that Berlin can or should block any ensuing takeover bid.

Orcel’s stake-building, seemingly executed under the nose of German Chancellor Olaf Scholz, has prompted domestic unease. Opposition politicians have expressed disquiet at letting another country oversee a key lender to German corporates. Financial sector sources told Breakingviews that Berlin might balk at Commerz being ultimately controlled by a group from Italy, where national debts are nearing 140% of GDP . And unions fear job cuts that will drive any deal’s synergies.

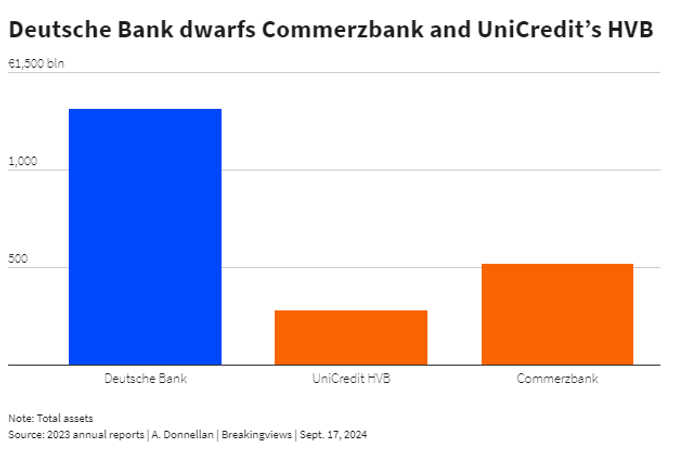

While Berlin’s remaining 12% Commerz stake seems insubstantial, bankers reckon a deal that neither the state nor Commerz Chair Jens Weidmann wants won’t fly. Still, Germany lacks a legal mechanism to block it, so in extremis would have to undermine its economic credentials as a level playing field by creating one. Meanwhile Weidmann presides over a bank that prior to the current M&A excitement traded around half its expected 2024 book value, and analyst forecasts compiled by LSEG only expect it to make an 8% return on tangible equity in 2025. Cutting out costs – either by splicing Commerz together with UniCredit’s German subsidiary HVB, or with $32 billion Deutsche Bank – is financially a no-brainer.

Yet as white knights go Deutsche doesn’t sound like a trouble-free option, even if CEO Christian Sewing is keener than he has appeared. A Deutsche-Commerz takeover might be able to strip out 40% of Commerz’s 6 billion euros of operating costs, an even higher proportion than HVB, a person familiar with the situation told Breakingviews. That might mean even greater union anguish over jobs.

Separately, if Weidmann or Scholz spurned a generous premium from UniCredit, they would be running up against a powerful institution that does actually have blocking powers. The European Central Bank’s Single Supervisory Mechanism has long advocated cross-border mergers in the euro zone. Last Thursday ECB boss Christine Lagarde pointedly reiterated her enthusiasm for that idea.

It remains possible that Orcel’s gambit creates sufficient political bother to prompt him to abandon a full takeover, perhaps in favour of a domestic HVB-Commerz merger that would see UniCredit hold a stake in the combined entity. Alternatively, the Bundesbank may throw sand in the wheels by preventing UniCredit from distributing HVB’s 23% core Tier 1 ratio somewhere other than Germany. But as things stand there are few good reasons to block a deal, and quite a few bad ones.

Updated 10:22 IST, September 18th 2024