Published 13:17 IST, August 7th 2024

China’s mounting bad debts have fewer places to go

Bohai Bank, based in the northern metropolis of Tianjin, has been hit hard by the country's property slump and slowing economic growth.

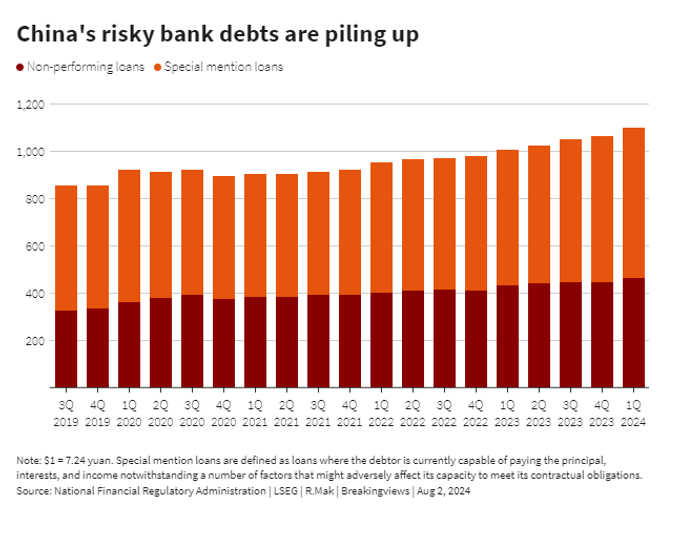

Clear-out. Tackling China's $470 billion bad debt pile is getting harder. China Bohai Bank, which is 16%-owned by Standard Chartered, recently said it's selling non-performing assets worth $4 billion. It underscores the pressure lenders are under as the country's property bubble bursts. Yet buyers are feeling the strain too.

Bohai Bank, based in the northern metropolis of Tianjin, has been hit hard by the country's property slump and slowing economic growth. The region, among China's most indebted, has grappled with plunging real estate prices - once a vital source of local government revenue - and overcapacity in its manufacturing sectors. Last year, nearly half of Bohai Bank's 932 billion yuan ($129 billion) loan book was in northern and northeastern China, where its profit before tax plunged to 1.7 billion yuan, down from 5.5 billion yuan in 2021. The bank's Hong Kong-listed stock is down 80% over the same period.

The $2 billion lender had 16.5 billion yuan of non-performing loans (NPLs), or 1.8% of total gross loans, as of December. But combined with special-mention loans - slightly less risky debt than NPLs - problem loans made up almost 5%. Bohai Bank plans to sell assets worth 29 billion yuan, which includes the principal, interest and such, at an up to roughly 40% discount. The bank will take a 3.8 billion yuan hit, equivalent to more than three-quarters of its 2023 net profit.

It's a chunky sale: though the assets account for less than 2% of Bohai Bank's total, the amount is 54% more than the non-performing assets the group disposed of in all of 2023. The seller appears to be getting a better deal, too. The average haircut on the principal for similar deals in Tianjin over the past three years was 71.7%, according to Bohai Bank.

The transaction comes at an awkward time for asset management companies known as bad banks. Beijing created the Big Four - China Cinda Asset Management, China Orient Asset Management, China Citic Financial Asset Management and China Great Wall Asset Management - in 1998 to acquire bad debts from the country's four largest lenders.

Updated 13:17 IST, August 7th 2024