Published 18:06 IST, May 29th 2024

CEO pay is hidden factor in US relisting trend

Ferguson, the $42 billion plumbing supplier, switched its primary listing from London to New York in 2022.

- Opinion

- 5 min read

Taking stock. The journey across the pond is getting crowded. Ferguson, the $42 billion plumbing supplier, switched its primary listing from London to New York in 2022, and $55 billion cement maker CRH followed last year. On Friday, $34 billion gambling group Flutter Entertainment plans to join them.

The switchers have offered a host of sensible reasons for ditching Britain in favour of the United States, like aligning their company’s trading venue with its most important market. Over time, however, one of the most tangible effects of the U.S. relisting might be something that boards are generally reluctant to talk about: higher executive compensation.

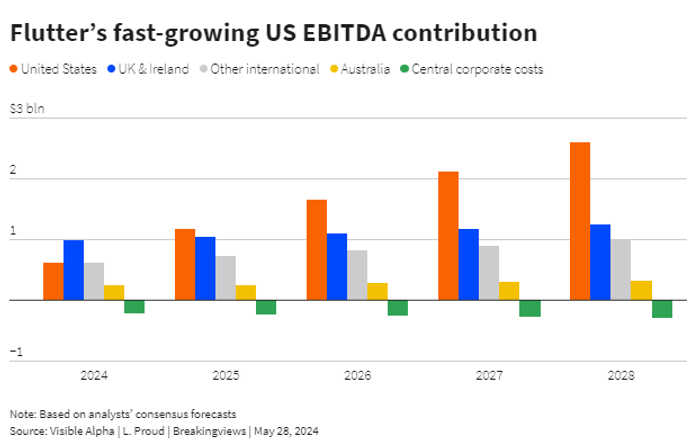

For Ferguson and CRH, the transatlantic hop was a no-brainer. North America accounts for the entirety of Ferguson’s EBITDA and 75% of CRH’s. It would be peculiar for the duo to retain a primary listing outside of their key geography, which also happens to be the world’s deepest capital market. For Flutter, the logic is less obvious, though still sound. U.S. sports gambling unit FanDuel is the company’s growth engine. Analysts reckon that Flutter’s U.S. EBITDA contribution will surpass that of the British and Irish bookmaking business next year and bring in half of the group’s total by 2027. The prospect of one day entering the widely tracked S&P 500 Index, meanwhile, will have appealed to all three firms.

It’s nonetheless hard to believe that the boards were oblivious to the transatlantic pay gap while hatching their plans. The median S&P 500 CEO earns $15.7 million a year, according to an ISS-Corporate analysis of the 343 firms that released new proxy filings between October last year and April 22. The median FTSE 100 CEO earns $4.9 million, Britain’s High Pay Centre reckons. Bankers and board directors who have been involved in other UK-U.S. relisting discussions told Breakingviews that greater pay flexibility is typically a key part of the appeal, even if companies don’t like to admit it.

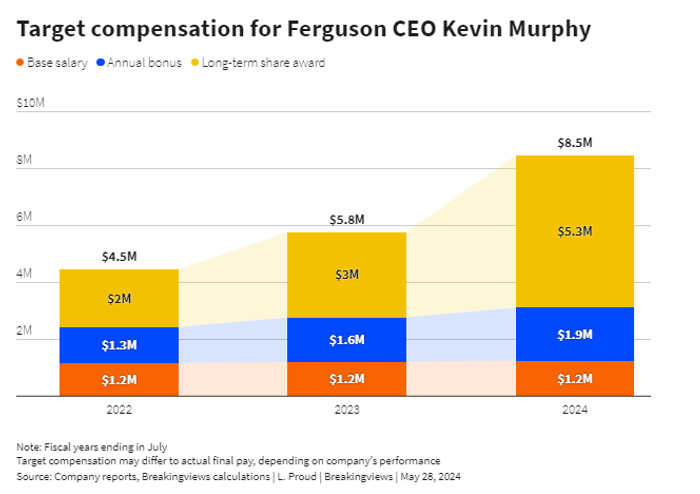

Ferguson’s actions, if not its words, arguably illustrate the point. CEO Kevin Murphy’s target pay, a goal that bosses can exceed or undershoot depending on performance, was roughly $4.5 million in the fiscal year ending in July 2022. The next year, which was Ferguson’s first full one with a New York primary listing, Murphy got a 30% target pay rise, followed by another hike of 47% for the current period. In just two years, his target pay has almost doubled to around $8.5 million.

It could be a coincidence that Murphy’s remuneration went up after Ferguson’s primary listing moved, though the group’s April proxy filing suggests otherwise. The board committee uses compensation consultants Mercer to review its pay practices, a process that the company said was aligned with its transition to being a “domestic issuer” under U.S. securities law. The implication is that Ferguson’s listing location is relevant to how it thinks about pay.

It’s too soon to see any change from CRH, though the company said in a recent filing that its compensation would “evolve to more closely align with U.S. practices”. That could in theory mean more money for CEO Albert Manifold, or just tweaks to the compensation structure. Flutter, for its part, is still close to the start of its pond-hopping journey. A person familiar with the matter, however, told Breakingviews that the board is considering the executive compensation practices of the U.S. market. Directors on the relevant committee are working with U.S. advisers on the topic and will engage with shareholders on any future changes, the person said.

Investors will probably have mixed feelings about this trend. Cynics will fear that it opens the door to London-based CEOs bullying boards into relistings that suit the boss more than the company. Ferguson, CRH and Flutter can’t be accused of that, since they have good business-focused reasons to move.

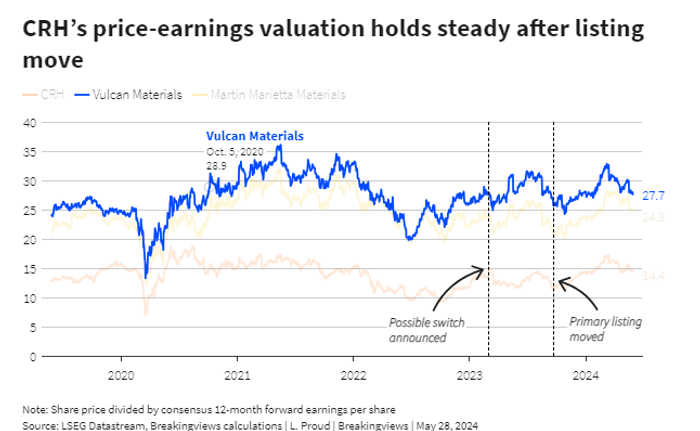

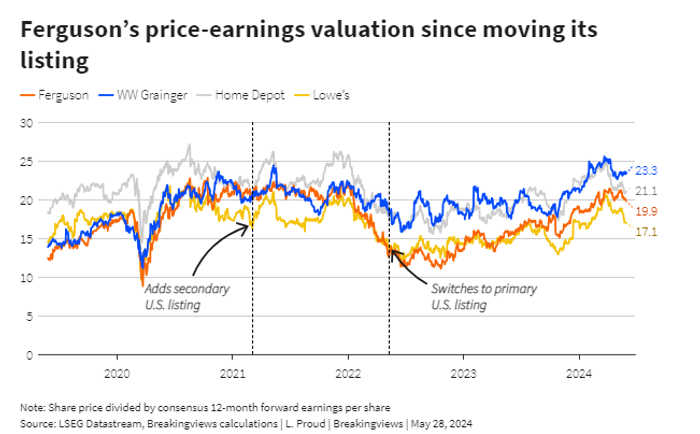

What might be more of a problem is if British firms with smaller U.S. businesses follow in their footsteps. After all, switchers’ share prices don’t seem to have benefitted much. CRH, for example, trades with roughly the same 45% valuation discount to the average of Vulcan Materials and Martin Marietta Materials as it did a year ago, using forward price-to-earnings multiples. Ferguson’s discount to Home Depot, Lowe’s and WW Grainger has closed, though the listing relocation doesn’t seem to be the cause. The gap was at historically high levels in early 2023, almost a year after it moved to a New York primary listing.

Pay-conscious boards have a better story to tell, if they’re brave enough to do it. The transatlantic compensation gap makes it extremely unlikely that a UK company would be able to hire a proven executive working at a high level in the United States, which shrinks the available talent pool. UK CEOs are frequently outearned by U.S. executives with less senior titles. Flutter’s boss Peter Jackson, for example, got about $5.8 million for 2023. The chief legal officer of DraftKings, which is a U.S.-listed competitor to just one of the many businesses that Jackson runs, got $6.6 million. Four other executives were awarded even more. London Stock Exchange CEO Julia Hoggett has pointed out that some proxy advisers and asset managers have ended up opposing UK compensation packages while supporting much higher ones in the United States.

AstraZeneca CEO Pascal Soriot, for example, saw proxy advisers and over a third of investors revolt against his near-$24 million pay deal for 2024. U.S.-listed Pfizer’s Albert Bourla, though, will probably get little heat for his roughly equivalent target remuneration for running a company whose market value is just two-thirds of $240 billion Astra’s. Often, the apparent discrepancy is because proxy advisers and some investors use local benchmarks to assess pay, rather than looking at global peers, which makes the national outliers more conspicuous.

It’s possible that U.S. bosses are just overpaid. There’s not much that British boards can do about that. It shouldn’t be surprising, though, that some directors see New York relistings as a way to bridge the gap.

Updated 18:06 IST, May 29th 2024