Published 16:16 IST, January 9th 2024

Budget buzz: What might the 2024-2025 budget hold for real estate?

India's booming real estate sector, set to grow to $1.04 trillion by 2029, calls for industry status ahead of the interim budget 2024-2025.

- Money

- 4 min read

Budget momentum builds: As the countdown to the 2024-2025 Interim Budget begins, the real estate sector eagerly anticipates potential policy reforms that could propel the momentum achieved in 2023. In 2023, the residential real estate market witnessed growth, with approximately 4.77 lakh units sold across the top seven cities and nearly 4.46 lakh newly launched homes flooding the market, according to Anarock report. Industry experts project a steady 9.2 per cent Compound Annual Growth Rate (CAGR) from 2023 to 2028.

Vivek Singhal, CEO, Smartworld Developers, expressed optimism about the market's future, saying, "As we approach 2024, the market gears up for sustained demand, propelled by various imminent factors. Consequently, the real estate industry has high expectations for the upcoming union budget."

The call for industry status

The scale and size of the real estate sector is booming like never before. According to Mordor Intelligence, the real estate industry in India is estimated at $ 0.33 trillion in 2024, and is expected to reach $1.04 trillion by 2029, growing at a CAGR of 25.60 per cent during the forecast period (2024-2029). A sector of such scale and size should be bestowed upon the industry status is what industry insiders are demanding ahead of the interim budget 2024-2025.

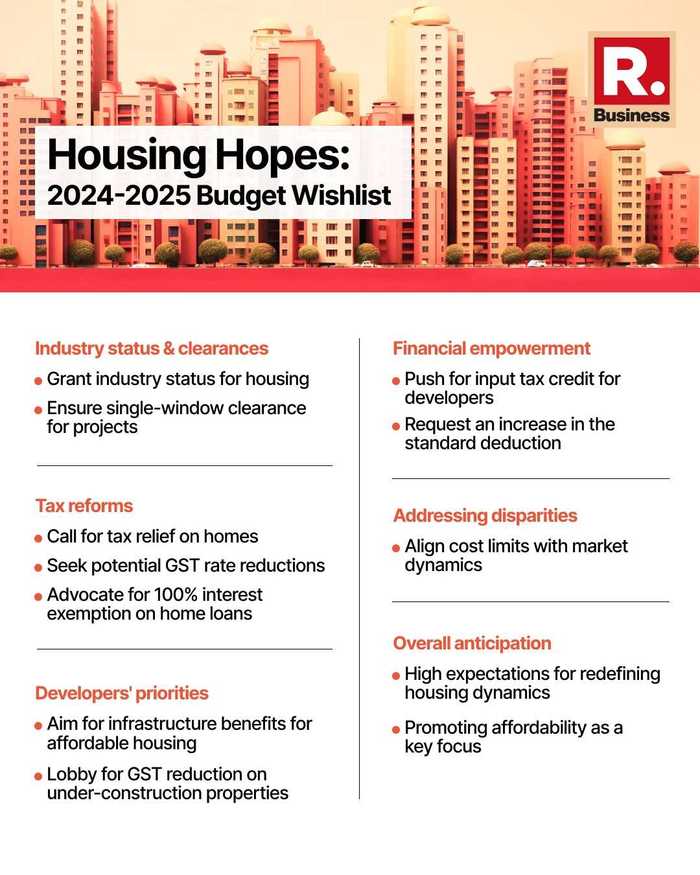

Key demands from industry stakeholders include a favourable industry status for the housing sector, maintaining single-window clearance for housing projects, potential reductions in Goods and Services Tax (GST) rates, and efforts to reconcile material prices. There is also anticipation for significant changes, such as the exemption of 100 per cent of interest paid on home loans and an enhancement of the standard deduction limit, leaving more investible surplus in the hands of customers.

Mohit Malhotra, Founder & CEO, NeoLiv, emphasised the importance of empowering new-age developers with financial backing and transparent policies. He highlighted the need for an input tax credit under GST as a pivotal requirement for development companies in this new era of the sector.

Council's pitch for home dreams

In a pre-budget memorandum, the National Real Estate Development Council (NAREDCO) has put forth several recommendations to enhance the housing sector's growth. Notably, NAREDCO proposes a separate deduction for principal repayment of housing loans under Section 80C, advocating for a distinct limit of Rs 2 lakh to encourage home purchase through housing loans. The council argues that this move would provide a significant boost to individuals opting for real estate investments, particularly second property buyers.

Additionally, NAREDCO suggests revisiting Section 194 IA, emphasising that limiting the setoff of losses may discourage people from considering real estate as an investment option.

The memorandum calls for the removal of limits on inter-head set off and recommends amendments to Section 23(5) to abolish notional income from properties held as stock-in-trade after two years or extend the period to five years. NAREDCO highlights that such changes align with the government's housing objectives, promoting surpluses in housing and incentivising rental housing amidst economic challenges induced by the COVID-19 pandemic.

Housing revolution wishlist

The industry's wish list for the upcoming budget remains consistent, with calls for critical reforms, including industry status for housing and streamlined clearance processes for housing projects. Developers also emphasise the need for tax breaks to incentivise the construction of more affordable housing units.

Rajat Khandelwal, CEO, Tribeca Developers, said, "Approaching the fiscal year 2024-25 budget, the country's real estate sector is actively seeking pivotal government backing." He highlighted priorities such as tax relief on homes, an elevation of the tax deduction limit for home loans, and implementation of schemes like GST reduction on under-construction properties.

Currently, Section 24(b) of the Income Tax Act allows you to deduct the interest paid on your house loan. A maximum tax deduction of Rs.2 lakh can be claimed from your gross income yearly for a self-occupied residence, provided the construction/acquisition of the house is completed within five years. Top voices from the sector are asking for raising the prevailing limits.

Pradeep Aggarwal, Founder & Chairperson, Signature Global, echoed the same expectations of transformative measures to rejuvenate the real estate sector. His anticipations align with the long-overdue grant of industry status, extending infrastructure benefits to the affordable housing segment, lowering GST rates on construction materials, and advocating for the establishment of a Single Window Clearance system.

Aligning rules with reality

The industry also highlights the need for addressing the disparity between government-defined parameters and practical market realities. The report suggests adjustments to the cost limit set by the government for properties in cities to align with market dynamics.

As the real estate industry awaits the unveiling of the interim budget, the stakes are high, and expectations run deep for measures that could redefine the housing landscape and promote broader access to affordable homes.

Updated 14:24 IST, January 31st 2024