Published 11:58 IST, January 1st 2025

Stock Picks For 2025: Axis Securities Bets On These Companies - See Target Prices

Axis Securities has brought out its ‘Yearly Technical Outlook’ for the year 2025 and listed sectors that may stand to gain from India's strong macros.

- Markets

- 3 min read

As D-Street bids adieu to a volatile 2024, the outlook for 2025 and near term is intact and bullish, according to brokerage reports. Axis Securities has brought out its ‘Yearly Technical Outlook’ for the year 2025 and listed sectors that may stand to gain from India's strong macros. We take a look at the ‘golden themes’ for the year 2025 along with the analysis for the year gone by. Excerpts of the report here:

Technical Relative Rotation Graph (RRG) Analysis – Sector Rotation

• Leading Sectors: BSE Healthcare, Auto, Telecom, Realty, Metal, Capital Goods, and Power maintain strong relative strength and momentum, staying in the Leading quadrant, signaling continued market leadership.

• Improving Sectors: BSE Bankex, FMCG, and Oil & Gas have moved to the Improving quadrant, presenting potential opportunities for bargain buying in quality stocks.

• Weakening Sectors: BSE IT and Consumer Durables are in the Weakening quadrant, suggesting profit booking, though a shift towards the leading quadrant indicates potential for value buying in quality stocks.

2024: Seasonal Rotation Of Stock Market

Jan-Mar: Historically, since 2008, the Sensex delivered an average return of -1.6 per cent with a 53 per cent probability since 2008. Most sectors

underperformed, with BSE Realty (-6.6 per cent) and Telecom (-5.1 per cent) emerging as the weakest performers, holding probabilities of 41 per cent and 35 per cent,

respectively.

Apr-Jun: The strongest quarter, delivering an average return of 5.8 per cent with a 76 per cent probability. Broader markets, including BSE Mid Cap and Small

Cap, outperformed the benchmark, with all sectors posting positive returns.

Jul-Sept: This quarter delivered solid gains, averaging 3.7 per cent with a 71 per cent probability of positive performance. BSE IT led the pack, recording an

average return of 8.3 per cent and a 76 per cent probability of positive performance.

Oct-Dec: Momentum softened, with the Sensex averaging a 1.7 per cent return and a 59 per cent probability. Most sectors delivered marginally positive

returns, except for outperformers like Bankex.

Fundamental Outlook - Six Golden Themes for 2025

Structural Play in Premium Consumption, Growth Story of the Indian Healthcare Industry, Companies with Higher Growth Potential in the Infrastructure value chain, Pharma and Telecom as a Defensive Play, Real Estate led by Demand Visibility, Reasonable valuation play in BFSI, Right mix of Rate Cut Cycle, Defensive, Infra, and Consumption.

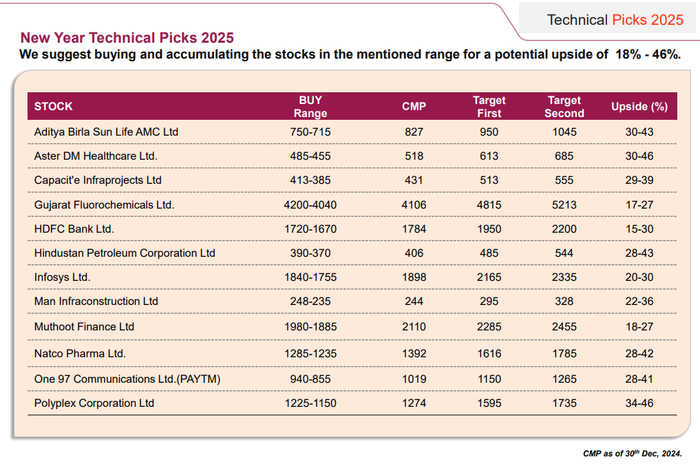

To Picks For The Stock Market

Axis Securities suggested a handful of stock options and their buying rate:

The views expressed in this article are purely informational and Republic Media Network does not vouch for, promote or endorse any opinions stated by any third party. Stock market and Mutual Fund investments are subject to market risks and readers are advised to seek expert advice before investing in stocks, derivatives and Mutual Funds

Updated 15:54 IST, January 1st 2025