Published 11:51 IST, September 3rd 2024

SEBI probe into insider trading, market manipulation sees multifold rise in 2023-24

This spate of investigations also comes against the backdrop of increased deployment of technology by SEBI to improve its policing and enforcement.

- Markets

- 2 min read

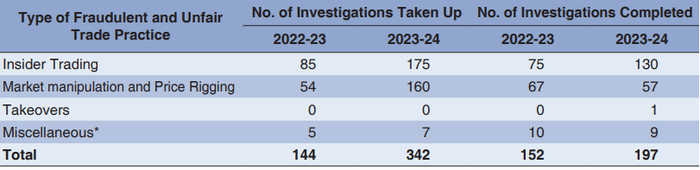

The Securities and Exchanges Board of India's (SEBI) investigation into insider trading and manipulation of markets have risen manifold in the financial year 2023-24. According to SEBI's recent annual report, the regulator took up 175 cases of insider trading-a sharp increase from 85 such cases in the previous fiscal. Investigations into market manipulation and price rigging have gone up to 160 in FY24 from 54 in FY23.

This spate of investigations also comes against the backdrop of increased deployment of technology by SEBI to improve its policing and enforcement. At the core of this has been the setting up of a dedicated lab with multiple sources of data, data analytics software, and digital forensic capabilities. These various tools, many of which have been developed in-house, are harnessed together by state-of-the-art technologies such as AI and ML that enable screening through the masses of both structured and unstructured data.

"These tools have substantially augmented SEBI's capability to detect and connect the dots between the entities suspected of defeating securities market regulations," SEBI said in its annual report. The ability of the regulator to process large volumes of trade data and identify suspicious patterns therein has been instrumental in its proactive approach against market misconduct.

Market Intelligence portal

Further arming itself with ammunition, SEBI also introduced the Market Intelligence portal on 1 April 2024. This would be a common platform for inputs of market intelligence from citizens and stakeholders relating to issues regarding price/market manipulation, insider trading, corporate governance violations, among others. Hence, this marked further democratisation of the process of regulatory oversight since more people are allowed to participate in maintaining the integrity of the market.

Experts say that in this day and age, pro-active vigil and technology-driven investigations are what SEBI needs to conduct in order to preserve the sanctity of the country's capital markets.

Updated 15:30 IST, September 3rd 2024