Published 12:10 IST, October 25th 2024

China robotaxi IPOs may struggle to find their way

Fully autonomous technology is largely confined to test environments, regulations are still evolving, and data needs for digital maps are onerous.

- Markets

- 3 min read

Ride on. Chinese robotaxis may struggle to navigate the Big Apple . WeRide is aiming for a valuation of as much as $5 billion for a New York IPO ; Pony AI, which is preparing its own market debut there, was valued at $8.5 billion in a private funding round last year, per IFR. But autonomous-vehicle companies have had a rough ride of late.

Toyota Motor-backed Pony, which runs a 250-strong fleet of driverless taxis and more than 190 trucks in China, says its technology leaves passengers “wide-eyed with wonder”. WeRide was the first to provide a paid taxi service using a high degree of automation known as Level-4, according to its prospectus, and has developed commercial vehicles including buses and roadsweepers. Pilot projects are underway in China, the United Arab Emirates, Singapore and France.

But the business model is as futuristic as the cars. Fully autonomous technology is largely confined to test environments, regulations are still evolving, and data needs for digital maps are onerous. Pony’s sales increased by a modest 5% to $72 million in 2023, though its net loss decreased to $125 million, from $148 million. WeRide is also unprofitable, and its top line fell by a quarter last year.

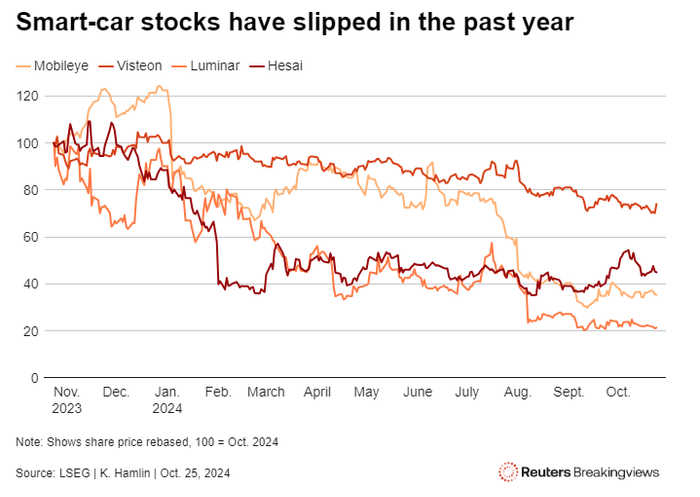

Meanwhile, investors’ confidence in the tech is flagging. Tesla ’s closely watched We Robot event this month was

However, companies are seeking prices that imply either breakneck growth or rich valuations. At $5 billion, WeRide's equity would be worth more than 100 times this year's sales, assuming full-year deliveries increase at a similar clip to the first six months of 2024. Pony's market value, even if it has eroded as much as Mobileye’s in the past year, would still be worth, at $3 billion, more than 20 times forward sales, using a similar calculation to estimate 2024's revenue. That compares with the average of roughly 4 times for a basket of peers, per Visible Alpha data.

Unless the top line accelerates dramatically, China’s new automotive upstarts may be asking investors to put the robot before the car.

Context News

On Oct. 24, Horizon Robotics, which makes software and hardware for driverless cars, debuted on the Hong Kong Stock Exchange after raising $698 million, implying a valuation of $6.7 billion in its initial public offering. Shares rose 2.8% on the first day of trading to close at HK$4.10. China-based autonomous driving startup WeRide has filed for a $119 million IPO on the Nasdaq and a private placement of $320.5 million, according to a term sheet seen by Reuters on Oct. 23. Rival Pony AI filed for an IPO in the U.S. on Oct. 17. The Toyota-backed company was valued at $8.5 billion based on its Series D private round in October last year, IFR reported.

Updated 12:10 IST, October 25th 2024