Published 17:31 IST, September 28th 2024

Southwest’s new flight plan carries excess baggage

Southwest Airlines unveiled plans to add assigned seats and ones with extra legroom to help generate $4 billion of operating profit by 2027.

- Industry

- 3 min read

Fare shake. Most travelers who arrive late to their destinations and with their luggage missing will not be mollified by free drinks and frequent-flyer miles. Southwest Airlines Chief Executive Bob Jordan and his management team are trying to placate the carrier’s suffering shareholders in a similar way. The outcome promises to be just as disappointing.

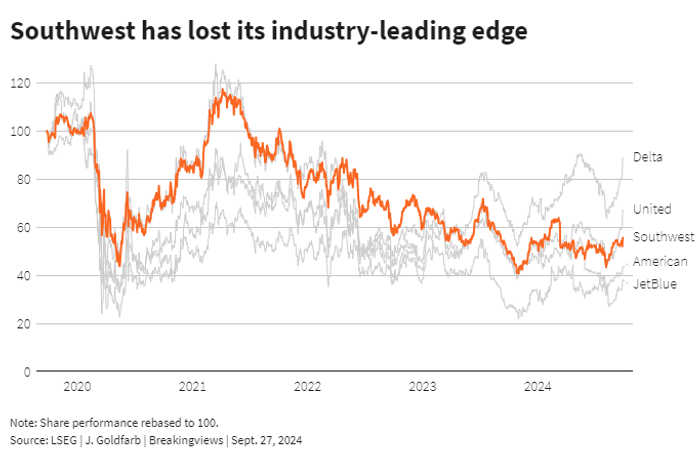

The $18 billion discount carrier unveiled a comprehensive and culturally disruptive turnaround plan on Thursday in response to a stock price that has more than halved since early 2021, underperformance that sparked an aggressive campaign against the top brass from pushy hedge fund Elliott Management. Southwest estimates that charging for assigned seats and more legroom will help lead to $4 billion of extra operating profit and a 10% margin by 2027. Also expected to contribute to the uplift are vacation packages, overnight flights, and selling some jets to eager buyers stymied by Boeing’s production woes.

Jordan’s proposed changes are welcome, albeit long overdue. The profitability target represents a big increase, but also falls short of the industry-leading 14% generated as recently as 2018, according to Visible Alpha. In the meantime, the broader plan will keep destroying value into 2026, with a projected return on invested capital of just 5% to 8% next year, below its roughly 9% weighted average cost of capital.

There are also good reasons to question whether Southwest, which defied spans of market-wide calamity by turning a profit for 47 consecutive years before the pandemic struck, will be able to achieve its goals under Jordan. Since he became CEO in early 2022, the company has trimmed its outlook at least eight times. His seasoned homegrown deputies have little experience working outside the company, a deficiency that could undercut efforts to introduce policies and practices so divergent from the airline’s culture.

Its multifaceted overhaul only stoked a 5% uplift in market value and, more significantly, failed to appease Elliott. Following the presentation, the firm repeated its threat to call a special meeting of shareholders to oust most of the board and Jordan. Although the airline has held conversations with its 11% stakeholder, appointed a raft of new directors, and adopted a stock buyback plan, it also is resolutely backing the boss. This dogfight will be a costly distraction that potentially slows the difficult strategic work ahead. Southwest has only itself to blame for inducing the financial air rage.

Context News

Southwest Airlines on Sept. 26 unveiled plans to add assigned seats and ones with extra legroom to help generate $4 billion of operating profit with a margin of at least 10% by 2027. The discount carrier also said it would roll out vacation packages, initiate overnight flights, partner with international peers, slow its annual capacity growth and sell some planes to leasing companies as part of the strategic overhaul. Southwest shares gained about 5%, closing at $29.93, following the presentation to investors. They have fallen 45% over the past five years. Elliott Management, which owns an 11% stake and has been pressing for changes at Southwest, said the new initiatives and targets did not change its opinion that Chief Executive Bob Jordan “lacks the vision and capability” to lead the company. The hedge fund manager said it “remains determined” to call a special meeting of Southwest shareholders to replace a majority of the board directors.

Updated 17:31 IST, September 28th 2024