Published 13:06 IST, July 16th 2024

Solar giant illuminates China’s overcapacity bind

China will examine whether European Union investigations of Chinese enterprises amounted to "trade barriers", the country's commerce ministry said on July 10.

- Industry

- 3 min read

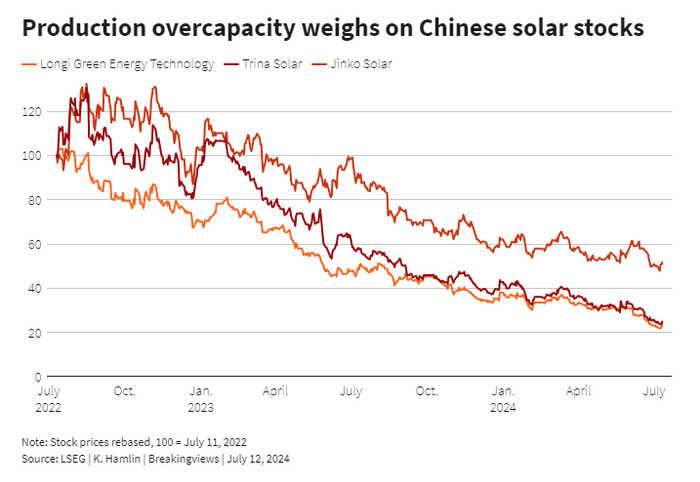

Déjà vu. The predicament of solar panel giant Longi Green Energy Technology suggests China risks repeating an investment boom and bust cycle that culminated in the European Union and the United States slapping anti-dumping duties on the world's second-largest economy a decade ago.

The $15 billion company warned last week it would log a net loss in the first half of up to 5.5 billion yuan, around $750 million, reversing a profitable run. It blames a supply-demand mismatch that has driven down prices of panel components including solar cells.

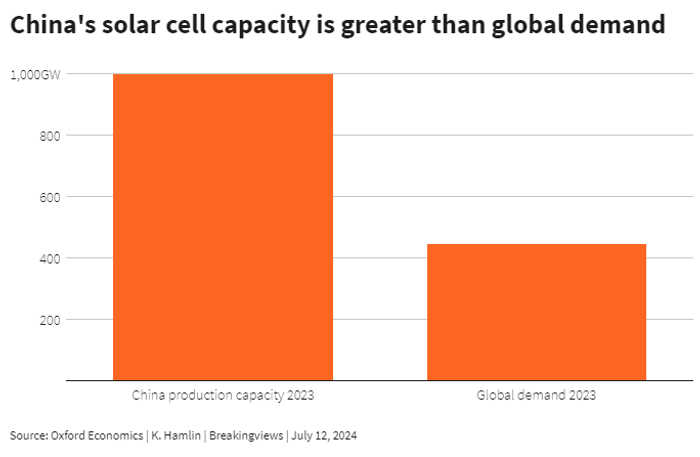

The scale of the problem is impressive. China's solar cell production capacity totalled 1,000 gigawatts last year, more than double global demand, which might in a bullish scenario only reach 980 GW by 2035, per Oxford Economics. Solar modules are now so cheap that in Europe they are being used as garden fences, Wood Mackenzie notes.

Beijing acknowledges various industries are grappling with excesses. Official statistics show manufacturing utilisation – the percentage of factories' capacity in use – falling from nearly 79% in 2021 to less than 74% this year. In March, the Government Work Report pledged stronger measures to tackle the problem. And on the day of Longi's profit warning, China published draft rules tightening investment regulations for solar manufacturing projects.

However, policymakers in China are fretting over the quality as well as quantity of goods. They want to produce higher value and high-tech goods; green and low-carbon projects are another priority, per the work report. Those goals complicate the effort to reduce the capital pouring into factories making things like renewable energy hardware, batteries and electric vehicles. The draft rules, for example, don't place an outright cap on total investments into solar, but they do attempt to raise standards by stipulating details such as the lifespan of products, and the minimum level of investment in research and development. Longi, despite a 40% plunge in its shares this year, plans to ramp up commercial production of its more advanced goods.

The result is a standoff. Brussels is probing Chinese companies including Longi to see if they benefit from various subsidies; China is investigating whether EU inquiries amount to "trade barriers". For now Beijing's balancing act isn't working and the sense of déjà vu is strong.

Context News

China will examine whether European Union investigations of Chinese enterprises amounted to "trade barriers", the country's commerce ministry said on July 10. The ministry listed photovoltaics among the industries covered by the probe, which was requested by the China Chamber of Commerce for Import and Export of Machinery and Electronic Products. Longi Green Energy Technology said on July 9 that it expects a net loss of up to 5.5 billion yuan ($756 million) for the first half of 2024. The solar company blamed its increased investments, as well as a mismatch between supply and demand.

Updated 13:06 IST, July 16th 2024