Published 14:27 IST, July 2nd 2024

New UK government can claim competence dividend

Britain will hold a general election on July 4. Opinion polls indicate that voters will end 14 years of Conservative Party-led government.

- Economy

- 5 min read

Loud and Keir. Eight years ago, Britain was reeling from its shock decision to leave the European Union. The political upheaval and economic uncertainty that followed raised the risk premium for investors in the country. If opinion polls are correct, voters will on Thursday replace the ruling Conservatives, who presided over that turbulent period, with a centrist Labour Party government. As France and the United States face unpredictable elections, Britain is beginning to look like a relative haven of stability. That gives Labour leader Keir Starmer the chance to cash in a competence dividend.

The 61-year-old is hoping to make Britain reliable again. The Conservatives churned through five prime ministers in eight years, including the disastrous six-week premiership of Liz Truss, who demolished what was left of the party’s claims to competent economic management. If Starmer secures a majority in parliament and completes a full term in office, he will be the first British prime minister in two decades to achieve that previously unremarkable feat.

It’s therefore no surprise that Starmer and Rachel Reeves, his likely finance minister, have put economic stability at the core of their manifesto. They see solidity as a key to attracting investment, which they hope will revive growth.

Labour could use some help. Britain’s productivity has lagged other developed economies, while Brexit has introduced new frictions to trading with the EU. The Covid pandemic pushed public sector debt to 100% of GDP. Schools, hospitals and public transport are suffering from years of underinvestment.

Yet there is no prospect of fully reversing the economic damage done by Brexit: Starmer has ruled out rejoining the EU’s single market or customs union. Meanwhile, Reeves has pledged to keep public debt under control, while promising not to increase income, corporate and sales taxes. That severely limits her ability to crank up spending.

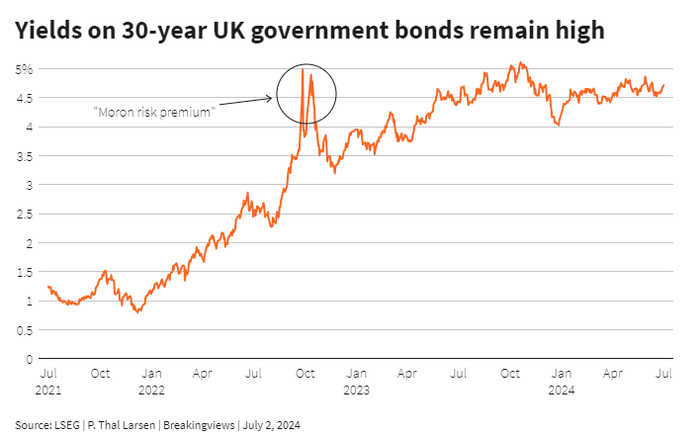

The financial benefits of stability are also hard to pin down. Take the yield on 30-year UK government bonds, which briefly spiked to 5% after Truss’s government unveiled its tax-cutting budget in October 2022. This included what Dario Perkins, an economist at TS Lombard, dubbed a “moron risk premium”. Though the yield today is only slightly lower at 4.7%, this is largely a function of stubborn UK inflation and the future direction of interest rates. A new government cannot quickly change that outlook.

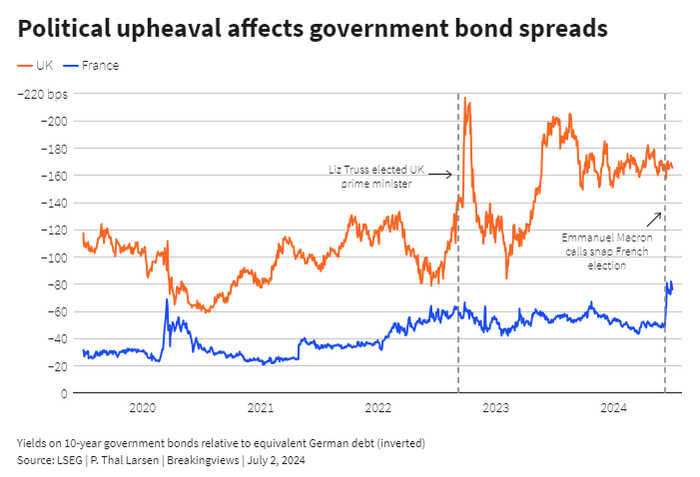

Another way to measure risk is to compare yields on government bonds. For example, the difference between the yield on French 10-year sovereign bonds and equivalent German debt has widened since French President Emmanuel Macron last month called a snap parliamentary election. On the same metric, the gap between 10-year UK and German bonds is narrower than at the height of the Truss-induced panic, but still wider than before she took office. However, the latter comparison is an unreliable guide to any risk premium attached to British gilts. France and Germany share a currency and a central bank; Britain and Germany do not.

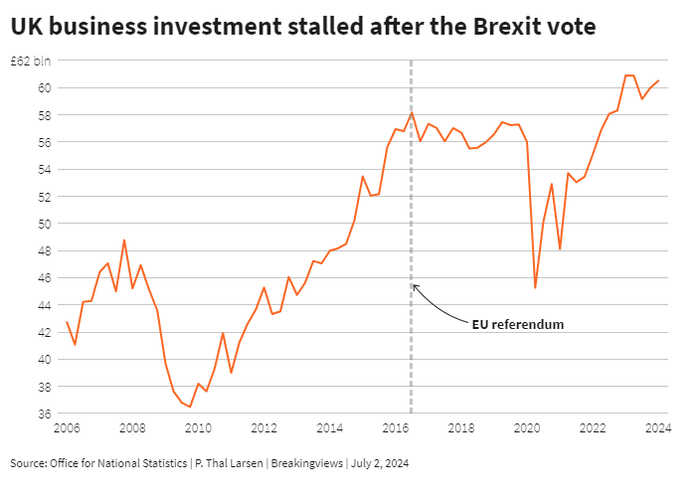

On some measures Britain may already be enjoying the benefits of renewed stability. A business barometer compiled by Lloyds Banking Group has recovered since late 2022 and remains above its long-term average. Business investment, which stalled after the referendum in 2016 and plunged during the pandemic, has recovered in recent years, helped by generous tax breaks on capital spending introduced by Prime Minister Rishi Sunak’s government.

Starmer might argue that investors are already anticipating a change of UK government. Many financiers in the City of London are indeed privately optimistic about a change of administration. They argue that a large majority will help the former barrister take long-term decisions and resist pressure from his party to boost spending.

Foreign investors should not expect a free-for-all, however. Though Reeves talks of stimulating investment through partnerships with the private sector, the former Bank of England economist also favours protecting workers and shoring up economic security. The party plans to scrap the “non-dom” rules that allow wealthy foreigners to escape tax on their overseas income. Labour has also been careful not to reveal too much about its programme. Even so, business leaders who looked on in growing despair as the Conservatives thrashed around in search of a coherent set of economic policies will welcome a more pragmatic approach.

Britain’s embrace of sobriety also contrasts with changes of direction elsewhere. France is facing a period of political and economic upheaval after the far-right Rassemblement National led by Marine Le Pen captured more than a third of the national vote in the first round of parliamentary elections on Sunday. Meanwhile former U.S. President Donald Trump is the favourite to return to the White House. For the first time since the Brexit referendum in 2016, Britain may have a government that, by international standards, looks relatively sensible.

Of course, political fortunes can change quickly: when former Prime Minister Boris Johnson won a convincing election victory in 2019, many expected him to rule for a decade. He lasted less than three years. A relatively open economy like the United Kingdom is also exposed to economic turmoil elsewhere. If Trump follows through on his threat to impose a blanket 10% tariff on products from the rest of the world he would hurt Britain, which sends more than a fifth of its exports to the United States. Slower growth in France would similarly rebound on its fifth-largest trading partner.

However, in a world where nations and regions compete for investment, image matters. The Brexit referendum and the political battles that followed made Britain the butt of jokes in boardrooms around the world. More recently, British CEOs have noticed that the country barely featured in international discussions. If voters are now ready to reward a party that promises stability, Britain can hope for a competence dividend. Assuming Starmer wakes up as prime minister on Friday morning, he should be able to claim it.

Context News

Britain will hold a general election on July 4. Opinion polls indicate that voters will end 14 years of Conservative Party-led government and hand power to the Labour Party.

Updated 14:27 IST, July 2nd 2024