Published 17:56 IST, December 27th 2024

Defence Sector: 5 Companies & Their Share Price Targets For 2025: See Brokerage Report

India's defence sector has been on a growth trajectory in the past few years supported by favorable policy initiatives by the government.

- Markets

- 3 min read

India's defence sector has been on a growth trajectory in the past few years supported by favorable policy initiatives by the government. Antique Stockbroking Ltd has released a research report on the Defence sector and the stocks gaining momentum in this sector.

The report projects that India’s defence sector has played well since the middle of 2021 and created significant wealth for shareholders. India's defence story has shown valuable growth

and earnings visibility. This growth shows a meaningful opportunity to accumulate defence stocks. The report highlights the defence sector coverage in-depth and allows us to remain bullish on the sector.

“Indian defence sector has given several multi-baggers during the past three years, with stocks rising by a whopping 3-4x to 8-10x between Sept -22 and July 24, before correcting from the peak in July -24. Our top picks are HAL, BEL, BDL, Mazagaon Docks, and PTC”, the report said.

Defence production to scale all-time high in FY25

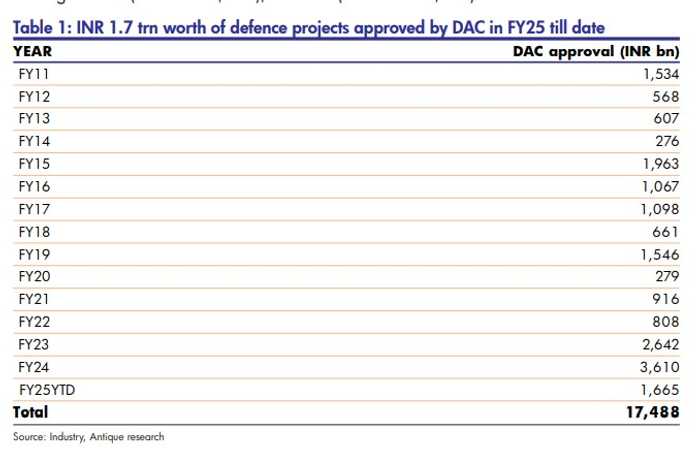

According to the report, in FY24 India's defence production stood at INR 1.3 trn+ and the government intends to further boost it to INR 1.8 trn in FY25.

According to the report, the government has taken multiple policy initiatives to ramp up domestic production by

a) Reserve 75 per cent of the defence capital procurement budget for the domestic industry in FY25.

b) Issuing five positive indigenization lists, products under which will be banned from import.

c) Integration of MSMEs and start-ups into the defence supply chain. An increase in domestic production will also help scale down imports which stand at 35 per cent of the total capex spend.

India’s Defence Exports Rise Up

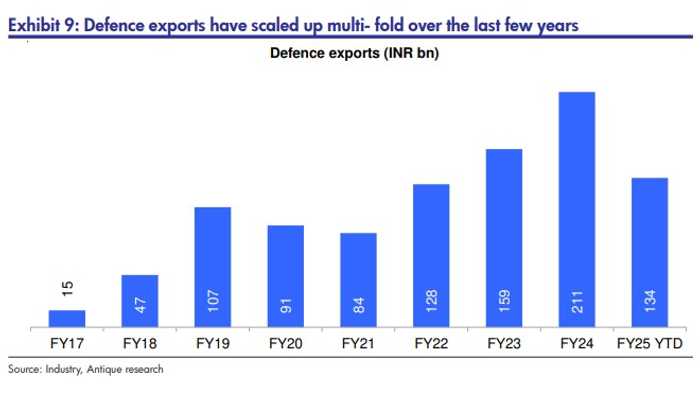

India's defence exports have increased 30x over FY14-24 from INR 6.9 bn to INR 210.8 bn with 60% of the contribution coming from the private sector and the balance 40% from

DPSUs. The target is to further increase defence exports to INR 500 bn by FY29.

Exports are happening in mission-critical weapon systems like missiles - BDL and Brahmos getting orders to Akash and Brahmos missiles. The report showed the gradual increase in defence exports citing the capabilities and growth in the sector. Defence exports have scaled up multi-fold over the last few years.

Defence Stocks To Keep An Eye On

HAL (HNAL IN)

CMP (INR): 295

M-Cap (INR bn) : 2,159

Reco: Buy

Target Price (INR): 373

Target FY27 P/E (x) : 40

BEL (BHE IN)

CMP (INR): 4,728

M-Cap (INR bn): 953

Reco: Buy

Target Price (INR): 5,513

Target FY27 P/E (x): 28 (Core)

Mazagon Docks (MAZDOCKS IN)

CMP (INR): 1,188

M-Cap (INR bn): 435

Reco: Buy

Target Price (INR): 1,357

Target FY27 P/E (x) : 40

BDL (BDL IN)

CMP (INR): 1,459

M-Cap (INR bn): 384

Reco: Buy

Target Price (INR): 1,627

Target FY27 P/E (x): 40

Cochin Shipyard (COCHIN IN)

CMP (INR): 12,360

M-Cap (INR bn): 185

Reco: Buy

Target Price (INR): 19,653

Target FY27 P/E (x) : DCF

PTC Industries (PTCIL IN)

CMP (INR): 1,554

M-Cap (INR bn): 178

Reco: Buy

Target Price (INR): 1,783

Target FY27 P/E (x): 30 (Core)

Garden Rch and Shpbldrs (GRSE IN)

CMP (INR): 1,554

M-Cap (INR bn): 178

Reco: Buy

Target Price (INR): 1,783

Target FY27 P/E (x): 30 (Core)

BEML (BEML IN)

CMP (INR): 4,010

M-Cap (INR bn): 167

Reco: Buy

Target Price (INR): 5,185

Target FY27 P/E (x) : 30

Also Read: Adani Ports Places Rs 450 Crore Order With Cochin Shipyard - See Share Prices | Republic Business

Updated 21:51 IST, December 27th 2024