Published 10:43 IST, October 11th 2024

Labor is on the Fed’s side against inflation

U.S. consumer prices rose 2.4% over the prior year in September, the Bureau of Labor Statistics said on Oct. 10, the lowest inflation reading in three years.

- Economy

- 3 min read

Working on it. U.S. Federal Reserve Chairman Jerome Powell faces a central banker’s most difficult task: cooling out-of-control price rises without choking the labor market. Conventional wisdom holds that these goals are in irrevocable tension. But now, labor is doing its part to reconcile the two. A steady flow of new workers and an uptick in productivity mean still-high wage and job growth isn’t stoking inflation, as evident in figures released Thursday. With the Fed eyeing further rate cuts, the risk now is that an immigration-hostile administration or fading output gains topple the balance.

The September consumer-price index report shows inflation falling to a three-year low. While slightly hotter than expected, at 2.4% year-over-year, it is barely over the Fed’s target. The tepid reading justifies Powell’s turn in August to focusing attention on incipient labor market cracks. There, too, progress came in last week’s employment report, with the economy adding a booming 254,000 new positions and the unemployment rate falling to 4.1% from 4.2% in August.

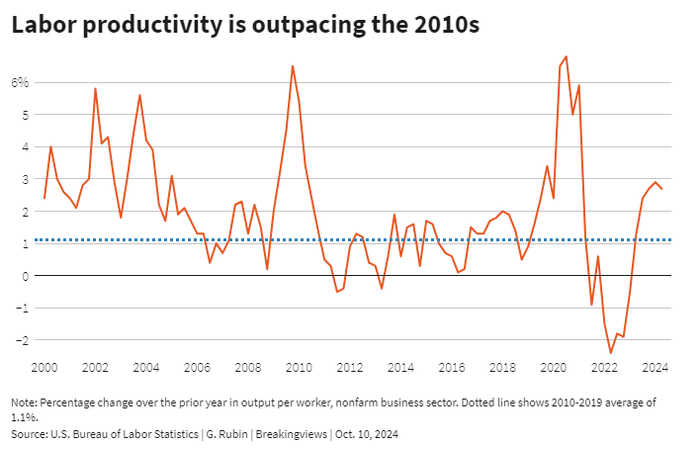

This seems contrary to economists’ standard warnings. Two key metrics provide a clue as to how it happened. Earlier in the recovery, the ratio between open roles and available workers hovered near 2-to-1, giving workers outsize leverage and propelling them to switch jobs and earn huge raises. That ratio is now closer to even — partly because positions were filled on the employer side, but also because new entrants added to the labor supply. The percentage of men ages 25 to 54 in the labor market is now 83.8%, a level not seen since 2001. Immigrants boosted the workforce, rising from 14% of workers in 2019 to almost 16% in 2023. Higher productivity improves the picture: While wage gains remain high at around 4% annually, worker output has outpaced its average between 2010 and 2019. Rather than bidding up costs without any offsetting benefits to employers, gains are now accruing to both, increasing the economy’s potential.

There’s some evidence that a flurry of new business formation in the wake of the pandemic is boosting productivity through competition and innovation. The danger is that there’s no guarantee that this trend will continue. Just look at job-switching, another post-Covid phenomenon, which has already faded. Meanwhile, labor supply would be threatened by a shift to more hostile immigration policy - an eminent possibility if Republican Donald Trump wins November’s election for the White House. For now, though, the labor force has helped the Fed stamp out inflation. Powell is trying to return the favor.

Context News

U.S. consumer prices rose 2.4% over the prior year in September, the Bureau of Labor Statistics said on Oct. 10, the lowest inflation reading in three years. The report follows employment figures released Oct. 4 that showed the unemployment rate ticking down to 4.1%. The Federal Reserve cut its benchmark interest rate by 0.5 percentage points at its September meeting, with further cuts anticipated.

Updated 10:43 IST, October 11th 2024