Published 13:39 IST, July 11th 2024

China’s financial sector is put on needed GDP diet

The change has been described colourfully by the central bank-owned outlet Financial News as "wringing water" from the numbers.

Raw data. It's usally a red flag whenever China's bean counters "optimise" already questionable market indicators. However, the recent tweak to how the country calculates what the financial sector contributes to the economy makes sense.

Many countries have grappled with how to measure financial intermediaries' so-called value-added - the value of goods or services produced minus the cost of inputs used in their production. Methods vary but most, including U.S. authorities, generally use some form of earnings, which for banks basically boils down to fees, commissions and net interest income. The People's Republic, though, focused on loan and deposit growth - until it quietly shifted towards profitability at the start of this year.

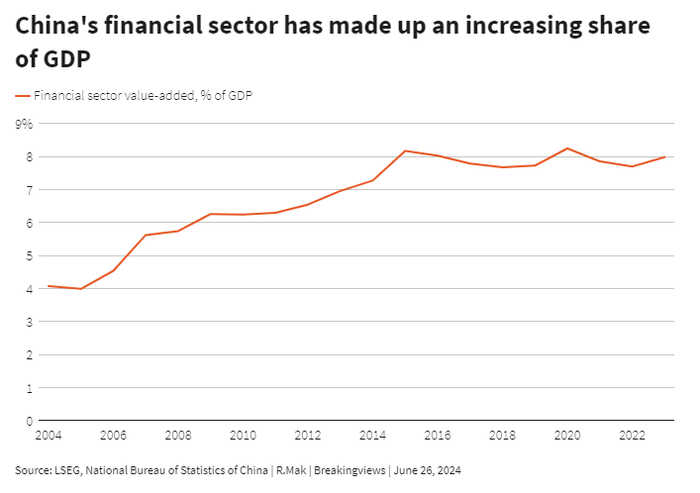

The change has been described colourfully by the central bank-owned outlet Financial News as "wringing water" from the numbers and "trimming deceptive fat" from the industry. In other words, basing the calculation primarily on asset and liability growth was probably overstating the financial sector's value-added. Last year, that figure was 8% of national GDP, on par with the United States. On a local level, it can be much higher: Nanjing, for instance, revealed that the city's financial sector made up 14% of GDP in the first three months of last year.

The problem is that bank balance sheets can be easily gamed to help officials hit their GDP growth targets. Some financial institutions, for instance, would borrow interbank deposits from other regions, according to one news report, only to return the funds after government data collectors have crunched the numbers. Speaking at a financial forum in June, central bank Governor Pan Gongsheng said the value-added tweak will discourage local governments and banks from inflating lending and deposit volumes during key assessment periods.

The revised calculation is already having an impact on some data. Total social financing, a broad measure of credit and liquidity in the economy, contracted month-on-month in April for the first time since 2005. Weak demand is to blame, but fewer incentives for banks to prop up loans and deposits probably accelerated the decline.

Making the switch this year could reduce the financial industry's contribution to the economy more than in recent years, considering an earnings crisis unfolding in the banking sector. Pan's broader message is that the central bank will prioritise the allocation and efficiency of credit over expansion. Refining the data is a sensible first step.

Context News

The Chinese government will release second-quarter gross domestic product data on July 15. China's National Bureau of Statistics has "optimised and adjusted" the way it calculates the value the financial industry adds to the economy, the Financial News, a publication owned by the People's Bank of China, reported on May 13. The changes took effect in the first quarter of 2024. Previously, the quarterly value-added, defined as the value of goods or services produced minus the cost of inputs used to produce them, was calculated primarily using banks' deposit and loan growth. Instead, the NBS is now taking into account bank earnings, including net interest income, net fees and commissions, the report stated. Separately, China's central bank governor, Pan Gongsheng, told the Lujiazui Forum in Shanghai on June 19 that the PBOC has been working with the NBS to optimise accounting of the financial sector to better reflect the industry's economic value-added and discourage local governments and financial institutions from inflating loan and deposit volumes.

Updated 13:39 IST, July 11th 2024