Published 12:58 IST, June 24th 2024

BHP investors throw CEO too short an M&A leash

If BHP could find some $1.5 billion of Anglo’s expenses to trim, those would be worth around $11 billion to shareholders once cashed and capitalised.

- Economy

- 2 min read

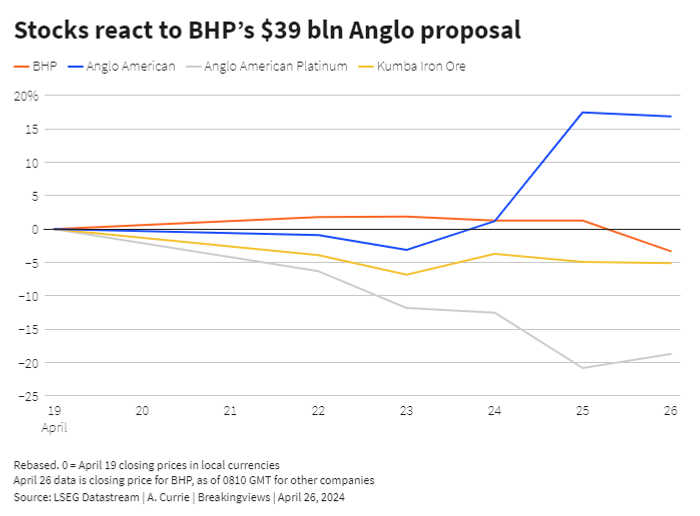

Heel!. Mike Henry may be wondering if he has been transported to an alternate M&A reality. BHP’s CEO could only watch as the miner’s market capitalisation fell 4.6%, or almost $7 billion, a day after the company revealed it proposed to buy Anglo American. The complex, all-stock potential transaction valuing the smaller rival at 31 billion pounds ($39 billion), which Anglo’s board rejected on Friday, was bound to cause some wobbles. But the reaction suggests shareholders reckon Henry is going to destroy value. That’s premature.

Granted, there are a lot of moving parts. Anglo’s stock price closed on Thursday a tad above the offer price, while shares fell in the two South African-listed entities which the target controls and BHP doesn’t want – Anglo American Platinum by almost 10% and Kumba Iron Ore by 1.3%. But Henry kicked off proceedings with a low-ball number that was more than $10 billion below the value of Anglo’s sum of the parts, Breakingviews calculates, excluding the two businesses which trade on the Johannesburg Stock Exchange. Costs stemming from divesting those two may add to the final outlay.

There are cost cuts to consider, too. If BHP could find some $1.5 billion of Anglo’s expenses to trim, those would be worth around $11 billion to shareholders once taxed and capitalised. Some or all of those cost savings could be used to justify paying a higher premium.

Things could get messy if one or more rivals decide to make a competing offer. For now though, Henry has a lot of wriggle room to up BHP’s bid without destroying value. Shareholders are trying to put him on too short an M&A leash.

Context News

The board of Anglo American on April 26 “unanimously rejected” BHP’s proposal to buy the company in an all-share deal that valued the miner at 31 billion pounds ($38.8 billion). As part of the proposal, Anglo American investors would receive 0.7097 of a BHP share for each Anglo share they own. Australia-listed BHP’s shares closed down 4.6% at A$43.15 on April 26, a day after the miner confirmed it had submitted a proposal to the board.

Updated 12:58 IST, June 24th 2024