Published 12:41 IST, December 27th 2024

SpaceX Will Be A Better $1 Trln Bet Than Tesla

SpaceX encapsulates Musk’s philosophy: do something different, then cut costs to drive out the competition.

- Companies

- 3 min read

Rocketing higher. Rocket maker SpaceX’s internal $350 billion valuation makes it among the globe’s most valuable private startups. That’s still a fraction of the worth of boss Elon Musk’s electric-car company Tesla, which sports a $1 trillion market value. In 2025, though, it will become clear that terrestrial ambitions are no match for the stars.

SpaceX encapsulates Musk’s philosophy: do something different, then cut costs to drive out the competition. Sure, Tesla’s 2006 “master plan” similarly pitched producing a premium car and then using the profits to drive down-market. But SpaceX’s growth is more explosive – and harder to catch.

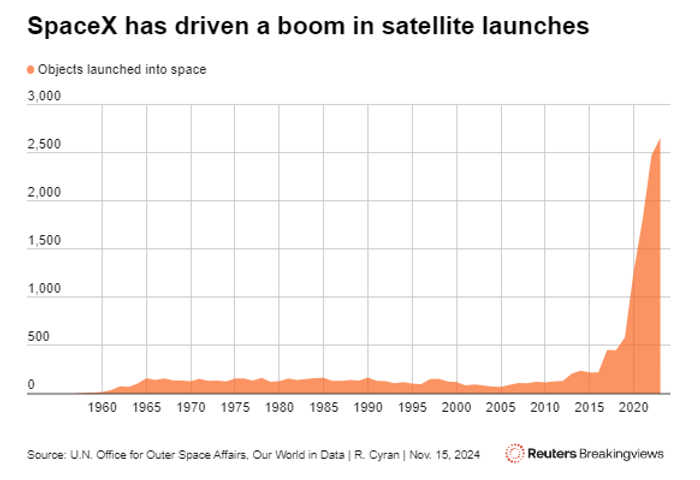

The key is Starlink, SpaceX’s broadband satellite network. Its success is twofold. First, by building bigger rockets that can be reused, costs to launch tumble precipitously. Second, Starlink’s superior performance versus rivals ensures a revenue stream that justifies more launches. The company has around 7,000 satellites whizzing around Earth and is adding about 60 a week. From 1965 to the early 2010s, there was essentially no growth in manmade objects launched into space. Starlink turned that trajectory parabolic.

This is an emergent monopoly. SpaceX accounted for over 85% of all orbital payloads in 2024’s first quarter, estimates BryceTech. This rapidly scaling vertical integration – encompassing rockets, satellites and user terminals – puts would-be rivals like Amazon on the back foot.

Tesla faces fierce competition from upstarts like China’s BYD and cheaper, good-enough fossil-fuel cars. SpaceX enjoys much clearer skies. Starlink only has 5 million users but is available in 114 countries. It’s adding cellphone service and has plenty of capacity. Musk’s connections to President-elect Donald Trump may help it land previously unavailable subsidies, such as $42 billion for rural U.S. broadband.

That leaves plenty of upside from the $6.6 billion of revenue that consultancy Quilty Space predicts for Starlink in 2024. EBITDA is projected to hit $3.8 billion, an astonishing 58% margin. TMF Associates foresees $24 billion of revenue by 2030. At today’s estimated profitability, that’s $18 billion of EBITDA. Given high fixed costs, more users could improve the bottom line.

So what is Starlink worth? Tesla trades at 68 times EBITDA, despite sputtering growth. Assume Starlink’s growth continues on its forecast path, put it on Tesla’s multiple, and the communications business would, at the end of the decade, be valued at well over $1 trillion. That’s not even counting SpaceX’s other valuable businesses like rockets.

Ultimately, it’s not clear why SpaceX is worth so little, Tesla so much, or both. As self-driving gets a reality check while the one-man space race continues, it will become clear that the stars are Musk’s real frontier.

Updated 12:41 IST, December 27th 2024