Published 17:53 IST, July 4th 2024

Smith & Nephew faces long and painful activist fix

Smith & Nephew has many ingredients activists look for in a target.

- Companies

- 2 min read

Deep surgery. Smith & Nephew should prepare for a long and painful activist treatment. On Thursday, Swedish investor Cevian Capital announced it had taken a 5% stake in the $11 billion UK-listed maker of hip joints and wound care kit. Its medicine is likely to involve stripping out costs. If that fails, more radical remedies like a breakup may be necessary.

Smith & Nephew has many ingredients activists look for in a target. Its share price has fallen 42% over the past five years, whereas the FTSE 100 Index is up by 10%. Endless management churn can’t have helped: during that same period the group has had three CEOs and three chief financial officers. Its boss, Deepak Nath, has introduced a 12-point plan to increase the company’s performance.

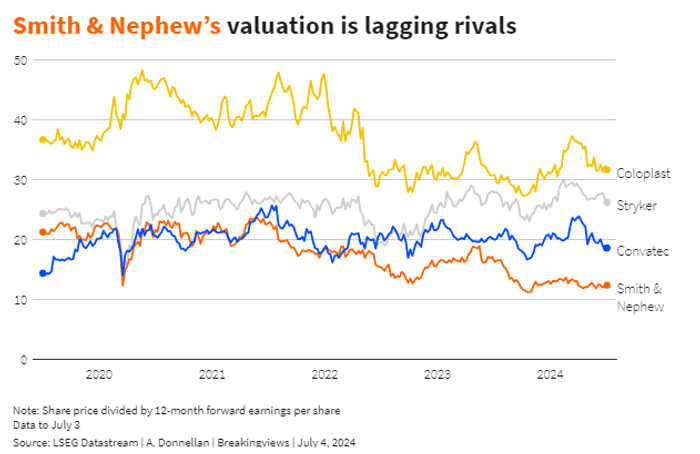

Investors, however, are not convinced. Including debt, Smith & Nephew is valued at $14 billion, just 13 times its expected operating profit in 2025, according to LSEG data, a steep discount to its five-year average of 18 times. Cevian has not yet disclosed its demands, but the activist could push Nath to take a bigger axe to Smith & Nephew’s bloated cost base, which resulted in an operating margin of just 17% last year. U.S.-listed rival Stryker generated a 24% margin.

Assume Smith & Nephew can close half the profitability gap with Stryker, and its EBIT margin would reach 21%. Apply that to the $6.7 billion of revenue the London-listed firm is expected to deliver in 2027, and operating profit could total $1.4 billion that year. Next, assume a leaner, more profitable Smith & Nephew is valued at 17 times forward EBIT, again closing half the gap with Stryker’s multiple, and its enterprise value could exceed $24 billion in two years. That’s nearly 70% higher than its current worth.

If Nath fails, deeper surgery may be necessary. Last year the orthopaedic division that makes artificial hip and knee joints was the slowest growing of Smith & Nephew’s business units. Selling that to a rival, like Stryker, could free up cash to invest in the other two units, wound care and sports injuries. Alternatively, switching its primary listing to the United States may attract more investors, and a higher valuation. But a recovery is likely to take time. As activist campaigns go, Smith & Nephew will be more than a quick fix.

Updated 17:53 IST, July 4th 2024