Published 14:50 IST, November 7th 2024

Elon Musk’s biggest conflict is with Donald Trump

Shares of Tesla opened up over 13% at the beginning of trading on Nov. 6, increasing the electric-car maker’s market capitalization by over $100 billion.

- Companies

- 3 min read

To the victor goes the spoils. Elon Musk has arrived. Shares of his electric car-maker Tesla added roughly $100 billion in value when markets opened Wednesday following Donald Trump’s presidential election victory. Musk backed the Republican to the hilt, and his vast web of business interests overlap – worryingly – with his new political role. The converse risk is that this puts him in the firing line of not only the trade war, but unpredictable leaders’ whims.

Musk’s sprawling empire empowered him with two pieces of ammunition that have rapidly put him as a key person in Trump’s corner. With a net worth of more than $280 billion, according to Forbes, he enriched Trump’s campaign with donations. He also has a pulpit: After the acquisition of $44 billion social network Twitter, now X, in 2022, he reinstated Trump's account, rolled back moderation policies that shifted the site's political mood, and broadcast unceasing support to his own followers. In return, Trump – who once boasted that he could have forced the tech entrepreneur to “drop to (his) knees and beg” – said that he may appoint Musk to oversee a committee on government efficiency.

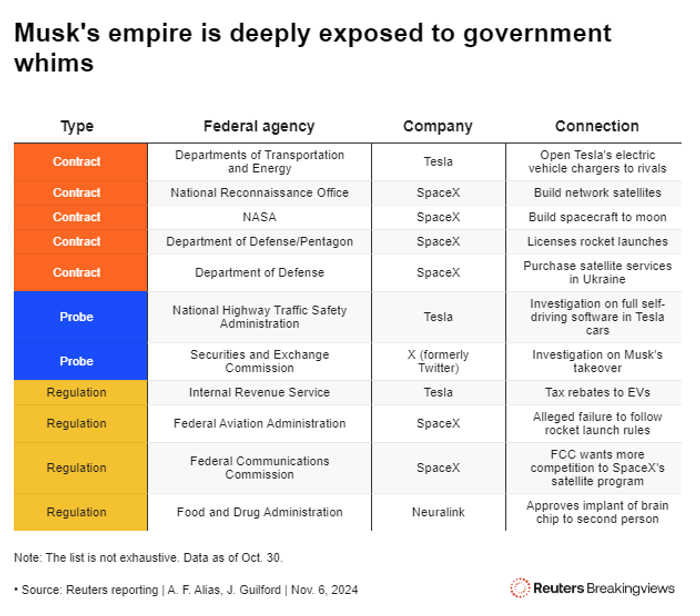

The Tesla boss is already deeply intertwined with the state. SpaceX, the $210 billion satellite company he controls, is building an espionage network for U.S. intelligence, Reuters reported. Governments on both sides of the Atlantic depend on it for reaching orbit, and its Starlink system is crucial in Ukraine. Tesla, meanwhile, benefits from government subsidies while also facing a bevy of investigations into safety and labor practices. Add in that the company is trying to roll out fully automated self-driving features that are subject to deep regulatory scrutiny, and Musk’s cozy relationship to the next U.S. leader smacks of concerning conflicts of interest.

There is, however, a converse risk. The north star of Trump’s political program is economic nationalism. He has promised across-the-board 10% tariff hikes on imports, rising to 60% on Chinese goods. Turbo-charging the trade war cuts against Tesla’s enduring advantage: a uniquely free rein to operate in the People’s Republic, home to 40% of its manufacturing capacity. Over a fifth of 2023 revenue came from the country.

Musk has enjoyed a relatively close relationship with Chinese officials, making a surprise visit to Premier Li Qiang in April. Regulators have ways to pressure or help him, like with restrictions on self-driving features. The benefit of potentially becoming a proxy for the White House is that Musk is now a conduit between China’s leaders and those in the United States, earning him the continued ear of both. But perhaps the greater risk is that he becomes a bargaining chip between the two. After all, the governments on which he relies are in direct and growing conflict. And those who depended on Trump have been disappointed before, judging by the near-endless list of former confidants booted from his prior administration. Ultimately, Musk’s vulnerability to the whims of either side is rising. Given enough time, that will haunt him.

Context News

Shares of Tesla opened up over 13% at the beginning of trading on Nov. 6, increasing the electric-car maker’s market capitalization by over $100 billion. The move comes after Republican Donald Trump was declared the victor of the U.S. presidential election, held the day prior. Tesla Chief Executive Elon Musk endorsed Trump, contributing millions to a political action committee and organizing get-out-the-vote operations. Trump has said that he would set up a commission on government efficiency to be headed by Musk.

Updated 14:50 IST, November 7th 2024