Published 12:40 IST, November 19th 2024

Nvidia’s growing cash hoard points to M&A

Nvidia’s cash has quintupled since 2020 thanks to an eight-fold revenue boost.

- Companies

- 5 min read

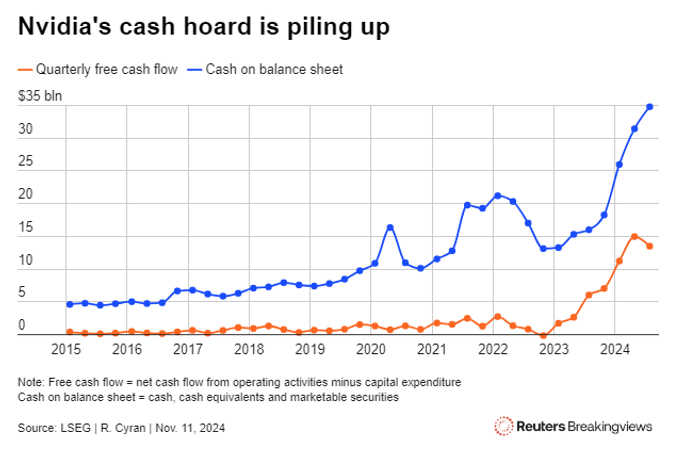

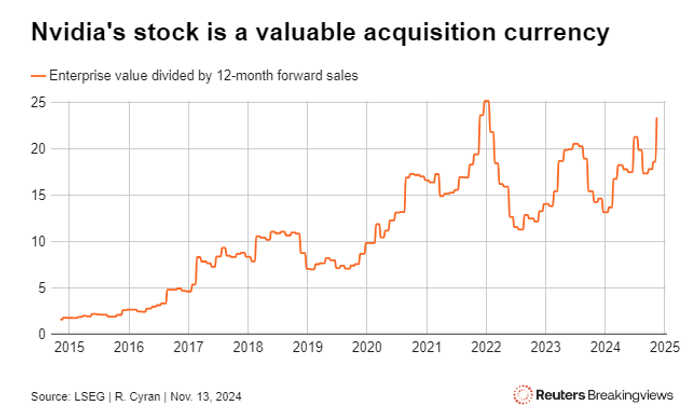

Racking up. Nvidia is making so much money that founder Jensen Huang doesn’t know what to do with it all. The $3.6 trillion chip designer is spending more on dividends and buybacks, but its cash pile is still growing, doubling over the past year to $35 billion amid a frenzy for the company’s artificial-intelligence chip designs. Combined with Huang’s prodigious ambition and a more lenient antitrust stance under President-elect Donald Trump, M&A may be back on the menu.

Nvidia has grown from a startup to the most valuable company on earth in the three decades since its founding. Huang’s 3.8% stake is worth more than the entire market value of fading $107 billion giant Intel. Nvidia’s big insight was to see how the industry could keep increasing computing power even as traditional processor speeds topped out in the early 2000s. It does this by providing chips and software that break the work into pieces so it can be done simultaneously, known as parallel computing. The hardware that the company designs is so in-demand that specialist manufacturers like Taiwan Semiconductor Manufacturing have little incentive to spend time supplying possible Nvidia rivals. Huang’s kit and the associated software have become standard among AI developers and in superfast data centers, which act as giant hubs of computing power for large language models like OpenAI’s ChatGPT.

As a result, Huang is coining it. Nvidia’s cash has quintupled since 2020 thanks to an eight-fold revenue boost. It will probably keep piling up. Free cash flow, or how much the company’s operations throw off after subtracting capital expenditures, will be $200 billion or more over the next two years, Bank of America analysts expect. Two years of dividends and share buybacks at their current rate would consume about $60 billion of that sum, meaning that in net terms the company’s pot of money would swell by about $140 billion. Add that to the existing pile of money, and Huang would start 2027 with about $175 billion of idle liquidity, which is more even than current cash king Apple. Along with the company’s richly valued shares, that affords ample M&A firepower.

Nvidia last attempted a big deal in 2020, when it agreed to pay $40 billion in cash and stock for chip architecture specialist Arm. Huang wanted to use the UK company’s basic semiconductor designs to help make data centers more power efficient. That deal failed after two years of scrutiny by governments and competition watchdogs in the United States, China and Britain. Nvidia could probably expect an easier ride under a more laissez-faire and nationalist Trump administration, particularly if it presented any deal as strengthening a U.S. AI champion. But buying another chipmaker is probably still verboten. For example, Huang might in theory like to snap up $78 billion Marvell Technology for its data-center networking technology and ability to design custom chips for AI developers. The semiconductor sector is global, though, and China and Europe would probably object again if Nvidia tries to buy players with scarce technology, like Marvell or Arm.

Other areas are probably open. Nvidia’s last successful acquisition, the purchase of Mellanox Technologies for $6.9 billion in 2019, provides some clues about Huang’s possible thinking. He bought the networking firm because he could see that computing was moving from working in parallel on a single processor to splitting the work even more widely among different chips. All these different bits of kit must talk to each other, and Mellanox provides the gear that facilitates those interactions. The trend is increasing given the massive workload of training and using AI models. To use a stylized example, a group of 100 servers all talking to each other will have almost 5,000 distinct connections between the different points, while a group of 1,000 would have nearly 500,000. This puts a greater emphasis on sending signals around the network extremely quickly, which is why Nvidia could in theory buy an optical networking firm like $16 billion Coherent, whose technology can connect data-center servers together at lightning speeds.

Huang, who has displayed an uncanny ability to foresee major technological shifts, could also go in more unusual directions. As Nvidia’s chips improve, the cost of doing computational work on them has halved roughly every two and a half years. That trend will probably remain on track for some time, making the hardware cheaper and more ubiquitous, and allowing more AI chips to show up outside the data center. That’s why Huang has repeatedly talked about new markets like robotics, autonomous driving and drug development. The company’s growing venture capital operation, which owns $1.8 billion of equity in smaller firms compared with essentially nothing a few years ago, provides a possible glimpse into the future. Huang has built up stakes in analytics company Databricks, which is mulling an initial public offering, robotics companies Serve Robotics and Figure, and drug discovery firm Charm Therapeutics.

Of course, analysts’ rosy forecasts for Nvidia could turn out to be too optimistic. AI has advanced rapidly in the past few years, in large part because the major companies have thrown more data and computing power at the problem. One risk for Nvidia is that this method of improvement may be offering diminishing returns, some researchers are increasingly warning, which would lead to slower growth and less demand for AI-ready chips. Another danger is that tech giants like Microsoft and Amazon.com could redirect spending towards specialized in-house designs as part of an attempt to ease Huang’s grip on the industry. If any of those risks materialize, Nvidia’s cash hoard might grow more slowly than current estimates suggest.

On the other hand, a less sunny outlook may even add impetus to any M&A hunt for Huang, who has a track record of turning the business on a dime. Even Nvidia’s current cash pile exceeds the market value of almost half of the companies in the S&P 500 Index. It would be a surprise if Huang simply sat on it.

Updated 12:40 IST, November 19th 2024