Published 21:27 IST, June 17th 2024

Nordic $5 bln insurer M&A limits cross-border risk

Finnish insurer Sampo has agreed to buy Topdanmark in an all-share deal that values its Danish rival at 33 billion Danish crowns ($4.7 billion).

- Companies

- 3 min read

Cross country. Cross-border M&A often proves a dicey business. Venturing into unfamiliar markets with different regulatory frameworks can go awry: Prudential’s AIA tilt in 2010 didn’t even make it to the altar. A deal that would see Finland’s $21 billion Sampo take over Danish group Topdanmark for $5 billion, in contrast, looks one that could succeed.

Sampo CEO Torbjörn Magnusson has grounds to consolidate. Costs have been rising across the insurance sector due to inflation. For many insurers a lag has emerged between the increased expenses incurred from claims, and the speed at which they can raise premiums. Offsetting that by stripping out mutual costs makes sense, and Sampo’s digital nous around claims management could be applied to Topdanmark’s business.

Maybe it can, but Magnusson also has a range of buffers that slash the extent to which he’s taking a leap into the unknown. One is that he already owns nearly half of his target. Topdanmark, which specialises in insuring property and liability for accidents, controls over 14% of its domestic market. Sampo has been keen for some time: the group first took a stake in 2007, increased its stake to 23% in 2011, topped it up in 2016 and hit its current 48% level in 2021.

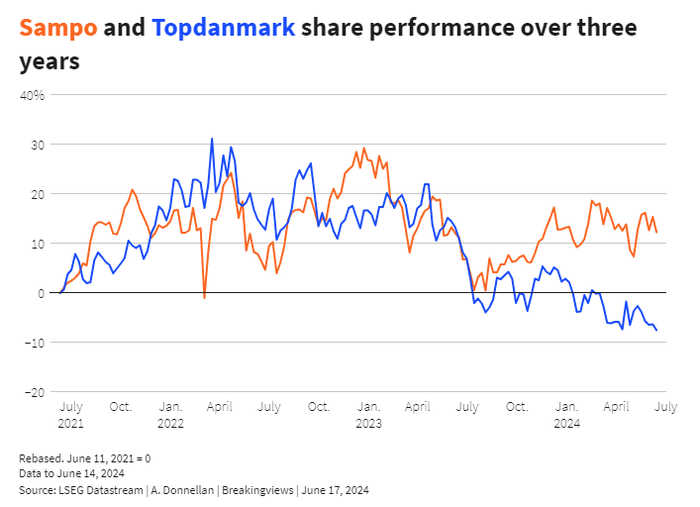

Owning half the company already cuts how much of his own Magnusson needs to give away. The 27% premium he’s advancing over Topdanmark’s undisturbed share price amounts to around 900 million euros, but he only needs to fork out about half that. He’s also paying in shares, and over the past year the Danish group’s share price is off 17% while Sampo’s has been flat.

Magnusson expects to deliver 65 million euros of cost synergies from the combination. Once those are taxed at Topdanmark’s 26% rate and capitalised they are worth 480 million euros. That implies Sampo is not overpaying – and if an extra 30 million euros of revenue synergies materialises the deal will start to look pretty compelling. Given this is cross-border M&A, though, it probably pays to think conservatively.

Context News

Finnish insurer Sampo has agreed to buy Topdanmark in an all-share deal that values its Danish rival at 33 billion Danish crowns ($4.7 billion), the two companies said on June 17. Sampo already owns 48.5% of the Danish property and casualty (P&C) insurer, according to LSEG data. Based on June 14 closing share prices, the offer represents a 27% premium for Topdanmark investors, the companies said in a joint statement. The companies said they expect the acquisition to result in annual cost savings of 65 million euros ($69.5 million) for the merged group and a further 30 million euros in higher income per year. Sampo said its offer was its “best and final” bid and that it would not be improved. Shares in Topdanmark were up 21% by 0722 GMT on June 17.

Updated 21:27 IST, June 17th 2024