Published 14:11 IST, September 11th 2024

Ireland can use unwanted taxes to keep Apple sweet

Ireland feared that accepting Apple’s back taxes would scare away its corporate golden geese.

- Companies

- 3 min read

Bitter sweet. Big Tech taxes are not the Apple of Ireland’s eye. That is the message Dublin sent when it sided with the iPhone maker in a European Union dispute over 13 billion euros in corporate levies. On Tuesday, Europe’s top court ordered Tim Cook’s company to pay the funds. Prime Minister Simon Harris can use the unwanted money to improve the infrastructure big companies crave.

The saga over Apple ’s Irish tax affairs dates back to 2016. After a lengthy legal back-and-forth, the European Court of Justice sided with the European Commission’s argument that the U.S. company paid too little taxes and ordered it to repay the funds into Dublin’s coffers.

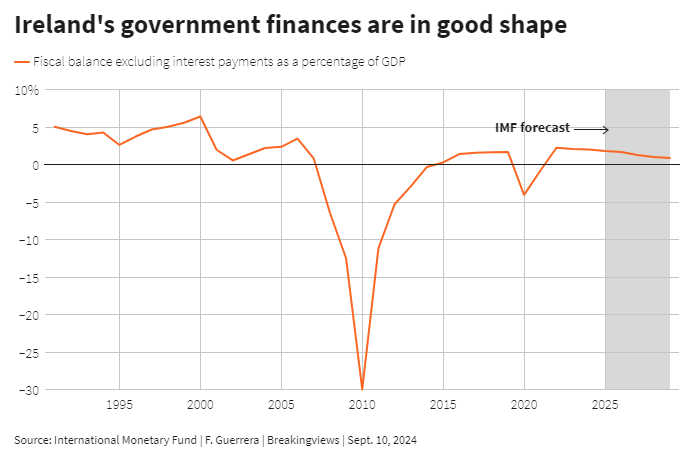

Ireland feared that accepting Apple ’s back taxes would scare away its corporate golden geese. The country attracts large multinationals like Pfizer, Facebook owner Meta Platforms and Salesforce with its 12.5% corporate tax rate. Paradoxically, the tax take from foreign companies has put Dublin in the enviable position of having a budget surplus. Last year it amounted to 8.3 billion euros and it is likely to stay around that level in 2024.

But Ireland’s days as a corporate tax haven are already numbered. The country reluctantly signed up to an OECD tax treaty in 2021 which set corporation tax at a minimum of 15%. In theory, higher levies might prompt Apple & co. to move to Paris, Amsterdam or Madrid. But those countries, and indeed most EU members, have higher corporate tax rates. Bulgaria and Hungary, which charge companies even less than Ireland, don’t look like likely alternatives.

So Harris has some time to persuade Big Tech and Big Pharma to stay put. He could spend Apple ’s taxes to increase Ireland’s attractiveness, even with a slightly tougher fiscal regime.

Dublin is in the throes of a decade-long housing crisis. In May, a survey by the Dublin Chamber revealed that two out of every three local businesses believe housing shortages impacted their ability to recruit staff. The lack of housing has increased rents by 60% since 2015, compared to 13% across the euro area, according to Eurostat. Transport is another weak area. Dublin is one of the few major cities in Europe without an underground train service and the government’s plan to build one has been delayed until 2035.

Ireland will have to handle its unwanted cash injection with care. But if it spruces up its infrastructure it may be able to keep the Apple and other companies from going sour on the country.

Context News

Apple on Sept.10 lost its fight against an order by European Union competition regulators to pay 13 billion euros ($14.4 billion) in back taxes to Ireland. The ruling by the European Court of Justice is a landmark decision in the EU’s crackdown against sweetheart fiscal deals between member states and multinationals. The European Commission issued the order in 2016, saying that the iPhone maker benefited from two Irish tax rulings for over two decades that artificially reduced its tax burden to as low as 0.005% in 2014. Apple had said the Commission’s decision defied reality and common sense. Ireland, whose low tax rates have helped to attract Big Tech to set up their European headquarters, had also challenged the EU ruling. After the ECJ’s ruling, Apple said: "The European Commission is trying to retroactively change the rules and ignore that, as required by international tax law, our income was already subject to taxes in the U.S." The decision is final and cannot be appealed.

Updated 14:11 IST, September 11th 2024