Published 13:01 IST, September 19th 2024

The Fed gives China several helping hands

The Chinese currency only started to really appreciate, though, on mounting expectations that the Fed would soon blink.

- Opinion

- 2 min read

At ease. President Xi Jinping owes Jerome Powell a big thank you. On Wednesday the chair of the U.S. Federal Reserve presided over a 50-basis-point cut to the benchmark interest rate. That, the central bank stated, was in large part due to "greater confidence" that U.S. inflation was heading back down to the target range. But the move also reduces devaluation pressure on the yuan, giving the People's Bank of China more room to bolster its own economy.

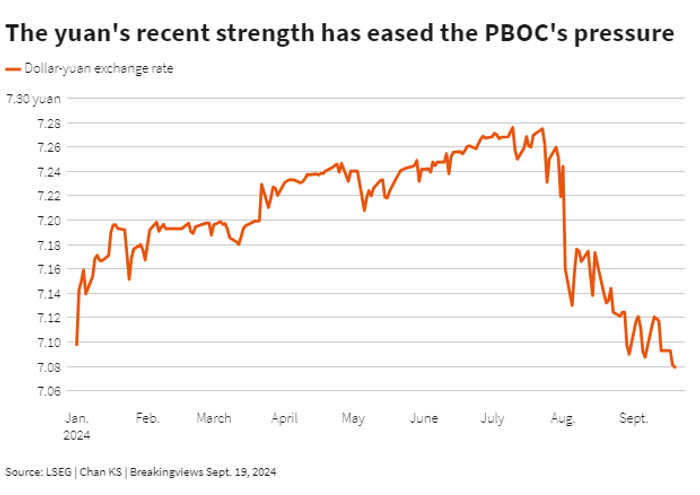

The PBOC, which has a legal mandate to maintain currency stability to foster economic growth, has been trying to put a floor under the sliding yuan since the United States started raising rates in March 2022. The Chinese currency only started to really appreciate, though, on mounting expectations that the Fed would soon blink; it's now up nearly 2.5% against the greenback since July.

Meanwhile, the chances of economic growth missing Beijing's target for 2024 of "around 5%" have been growing. Recent data reinforce that: retail sales in China rose only 2.1% in August despite the summer travel peak, down from a 2.7% increase a month earlier. The housing market slump continues, with property investment dropping another 10.2% in the first eight months of the year compared to the same period in 2023. Such weakness has prompted a raft of investment banks to downgrade their full-year projections for China’s GDP growth.

The Fed's larger-than-expected cut means the PBOC can now focus on helping Xi hit the GDP goal by reducing the country's own borrowing costs. That could start as early as Friday, when the central bank is scheduled to set loan prime rates. Expectation is also high that the PBOC will slash interest rates on existing mortgages. That could help further deflate a bond bubble which has sent yields to record lows and which regulators have been grappling with for months.

A key official at the PBOC said earlier this month there is room to cut the required reserve ratio on banks to free up more liquidity. The central bank could even increase the size of a lending programme to help local governments purchase unsold property inventories to turn into affordable housing.

Senior U.S. and Chinese economic officials will meet in Beijing on Thursday again to discuss issues ranging from industrial overcapacity to cooperation on financial stability . The Fed’s interest-rate decision just hours before the meeting could not have been better timed.

Updated 13:01 IST, September 19th 2024