Published 14:56 IST, August 31st 2024

Tech’s also-rans are ripe for the plucking

That gap has increased since 2021, while software stocks overall have lagged the broader market.

- Opinion

- 2 min read

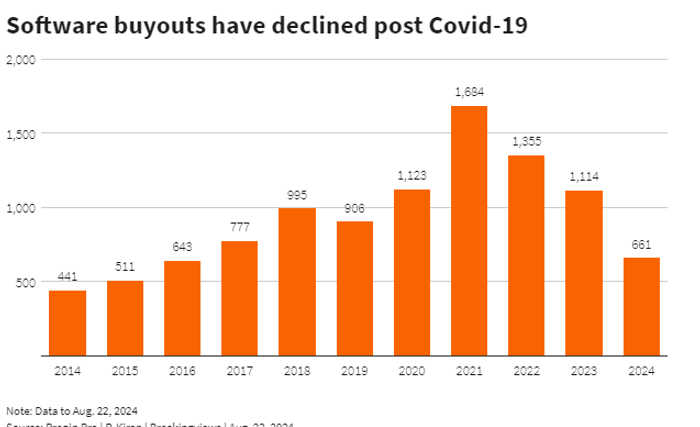

Price takers. Software buyouts are ready for a reset. A host of firms went public in the pandemic years only to lose investors’ favor. Yet, as high interest rates bore down and the path for valuations remained unclear, private equity has coaxed fewer and fewer sellers to sign deals since 2021’s peak. Bulging war chests, increasingly diverging fortunes between the haves and have-nots, and regulatory limits on Big Tech may break the logjam.

Young software firms are in a bind. The now-standard model is that, in the early days, they spend heavily to chase growth and snag clients on renewing subscriptions. That weighs on profitability, though - and with the era of zero rates in the rear-view mirror, promises of future rewards are discounted. Over 85% of the companies on Software Equity Group’s SEG Software-as-a-Service Index fall short on the rule of 40 metric, a combination of revenue growth rate and EBITDA margin used to benchmark profitable expansion. Those exceeding the threshold win valuations over twice the median company’s 5.7 times trailing revenue.

That gap has increased since 2021, while software stocks overall have lagged the broader market. The direction of travel might finally influence executives’ outlook. Even fast-growing GitLab, sporting a buy recommendation from 12 out of 15 analysts polled by Visible Alpha, is considering a sale, according to Reuters. The $7 billion company’s shares are down nearly 60% since its initial public offering.

Buyout barons will hope others follow suit. With a record $2.6 trillion in dry powder, they have plenty of firepower. Recent results show managers like Blackstone and KKR spending it in earnest. And for sellers weighing their options, private equity may sometimes be the only choice: tougher trustbusting under the Biden administration has crimped tech goliaths from scooping up smaller rivals.

Recent buyouts neatly fit the mold. Education software maker PowerSchool and website builder Squarespace both went public in 2021, lagged on the rule of 40, and have now sold, to Bain Capital and Permira, respectively. To grease the wheels, existing investors eyeing a richer payday can come along - Squarespace’s backers General Atlantic and Accel will reinvest in the company.

None of this means that M&A overall will zoom back to its peak. Nonetheless, despite a chilly start to the year, private equity has notched 661 software deals in 2024 so far, on pace to pass the pre-pandemic five-year average of 673, according to Preqin. Stragglers ripe for the plucking will help.

Updated 14:56 IST, August 31st 2024