Published 14:46 IST, July 13th 2024

Smaller tech grapples with end of Big Tech put

Assuming Alphabet isn’t coming back, HubSpot’s options have narrowed.

- Opinion

- 3 min read

Always the bridesmaid. A jilted HubSpot will break many hearts. It apparently will not be acquired by Alphabet, after all. Like many of its peers, the $25 billion software developer has been trading at a premium valuation, at least partly in anticipation of a larger rival scooping it up. The thesis is quickly losing credibility.

HubSpot, whose technology helps small- and mid-size companies with their marketing efforts, was identified by Reuters earlier this year as a potential takeover target for Google’s owner. Alphabet has walked away, however, Bloomberg reported this week. It is the industry’s second major deal collapse, after Adobe ran into regulatory roadblocks over plans to pay $20 billion for design software rival Figma.

Assuming Alphabet isn’t coming back, HubSpot’s options have narrowed. Microsoft tussled with trustbusters for nearly two years to buy video-game maker Activision Blizzard, and CEO Satya Nadella may not be ready to fight yet again. Salesforce, another plausible suitor, has been chastened by investors, who pushed back against its patchy track record of acquisitions. HubSpot would be a chunky leveraged buyout.

There’s little reason for CEO Yamini Rangan to fret, however. HubSpot’s annual recurring revenue and operating profit are both projected to increase about 25% between this year and 2025, according to estimates gathered by LSEG. The company also recently reshaped agreements with third-party vendors to boost growth and lower costs. An expanded suite of products could help reduce customer churn.

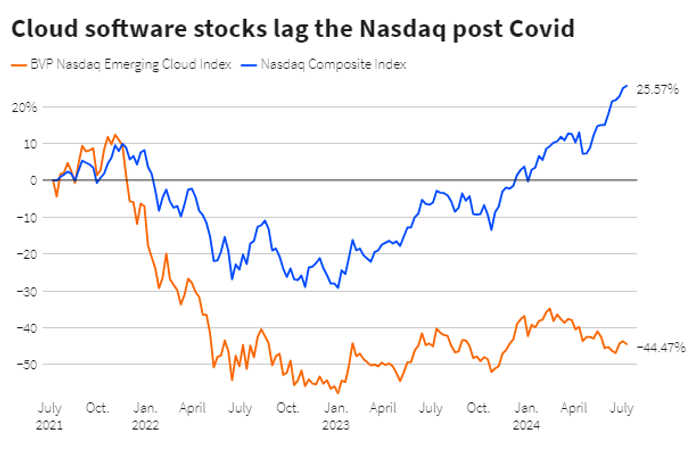

Rangan’s peers across Silicon Valley have more to fear. Software makers, as counted in the BVP Nasdaq Emerging Cloud Index, have lost half their value from the pandemic-era peak. And yet in the first quarter, software-as-a-service companies were trading at a median of 6 times trailing 12-month sales, according to M&A advisory boutique Software Equity Group. The multiple represents a nearly 60% premium to what buyers paid in acquisitions over the same span. The uplift can be justified for fast growers, but a third of those included in Software Equity Group’s SaaS Index were not able to increase their top lines by more than 10% while just one in 10 exceeded 30%.

Pushback from competition authorities is weighing heavily. Technology-related M&A last year dipped to its lowest volume in a decade, according to S&P Global’s 451 Research. Alphabet, Amazon.com, Apple and Meta Platforms have struck just 44 deals so far this year compared to 138 in 2019, Dealogic data show. Smaller tech and its backers may have to curb enthusiasm for the Big Tech put.

Updated 14:46 IST, July 13th 2024