Published 14:28 IST, September 24th 2024

New consumer CEOs start life in the slow lane

Nike last Thursday said that former executive Elliott Hill would return to replace CEO John Donahoe.

- Opinion

- 3 min read

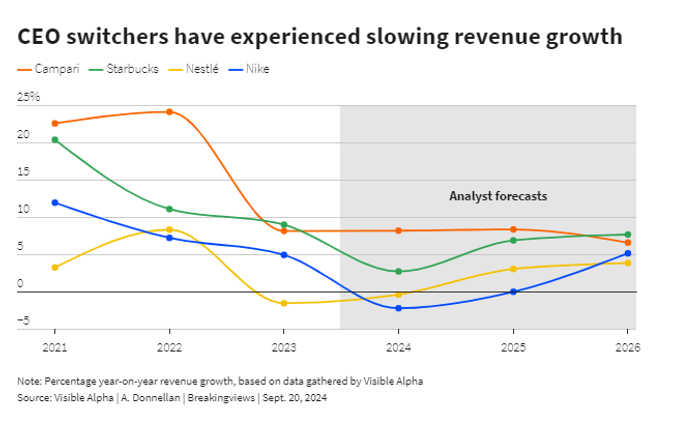

Hot seat. The bosses of large consumer groups have good reason to watch their backs. Nestlé, Starbucks, Davide Campari Milano and now Nike have all ditched their CEOs in recent months amid poor performance. Admittedly, there is plenty the new bosses can do to unpick past mistakes. But it’s probably no accident that all four switches happened amid weaker consumer spending. It suggests quick fixes may be out of reach.

Nike last Thursday said that former executive Elliott Hill would return to replace CEO John Donahoe, whose term as chief of the $130 billion sportswear giant started in 2020. That followed $250 billion Nestlé’s sudden replacement of CEO Mark Schneider with insider Laurent Freixe, announced late last month, and Starbucks’ mid-August decision to bring Chipotle head Brian Niccol in for Laxman Narasimhan after less than two years. The award for the quickest switcheroo, however, goes to $10 billion Aperol and Courvoisier maker Campari, which announced on Wednesday that CEO Matteo Fantacchiotti would leave for “personal reasons” after just five months.

The changes surprised investors. The Starbucks move initially added $20 billion to the coffee chain’s value, while Nike’s shares closed up 7% on Friday. It’s also part of a wider trend towards shorter CEO tenures. The average term of an S&P 500 boss has declined from a peak of over 11 years to less than nine years last year, according to data from executive recruitment firm Spencer Stuart.

There’s plenty for the new guard to get their teeth stuck into. Nestlé, for example, has probably underinvested in advertising for years. At Starbucks, Niccol could improve the company’s digital-marketing strategy and quality of food and drink. Outgoing Nike CEO Donahoe, meanwhile, arguably pushed too aggressively into direct-to-consumer selling while neglecting retail channels, which new boss Hill could potentially try to revive.

On the other hand, it’s unlikely to be a coincidence that four large consumer-facing brands have suffered from slowing sales growth simultaneously. A weaker global economy is also to blame. Campari, for starters, is struggling because of weak Chinese demand. In the first six months of the year, its Asia Pacific sales fell by 12% year-on-year. Fantacchiotti left after he suggested that the wider drinks market was still on the soft side. Starbucks and Nike’s problems, however, are closer to home. Inflation is making shoppers more cost conscious, which is leading to disappointing sales. Nestlé, which sells Nescafé and KitKats, is also exposed to a weaker U.S. consumer.

The upshot is that any shareholders hoping for a quick recovery in sales may be disappointed. Economic slowdowns have a habit of revealing the strategic problems lurking underneath a company’s surface. But they’re also a tough time to launch a turnaround.

Updated 14:28 IST, September 24th 2024