Published 21:35 IST, July 11th 2024

Markets will keep shaky French regime on a leash

Whoever will end up governing France will inherit a country with a budget deficit.

- Opinion

- 3 min read

In a bind. France’s debt problem would be hard to tackle even if Emmanuel Macron had been a popular president supported by a comfortable parliamentary majority. The current stalemate, with the united left coalition and centrist parties fighting to form the next government, makes it harder. And the next government will have another awkward partner: the bond market.

Whoever will end up governing France will inherit a country with a budget deficit and public debt at 5% and 112% of GDP respectively last year. The political stasis could lead to fiscal insouciance. A minority or coalition government led by the New Popular Front left grouping may want to implement at least part of its platform, which includes 100 billion euros of extra spending by the end of 2025. And even if a centrist-led government emerges, led by Macron’s Renaissance movement, it may suspend the 20 billion euros of savings that current finance minister Bruno Le Maire had pencilled in for this year.

The new regime’s first problem will be to abide by the European Union’s requirement to shrink the country’s debt. Paris could ignore the EU’s concerns, but it would risk penalties, and the suspension of some 10 billion euros of subsidies remaining from the pandemic-era Recovery and Resilience Plan.

And political games wouldn’t help France with bond markets. Paris is vulnerable to changes in investors’ sentiment, with 54% of government debt in foreign hands — up from under 50% two years ago. The European Central Bank still holds around 20% of French sovereign debt, providing a cushion in case of a market sell off. But France can’t count on further central bank support if it doesn’t comply with EU requirements.

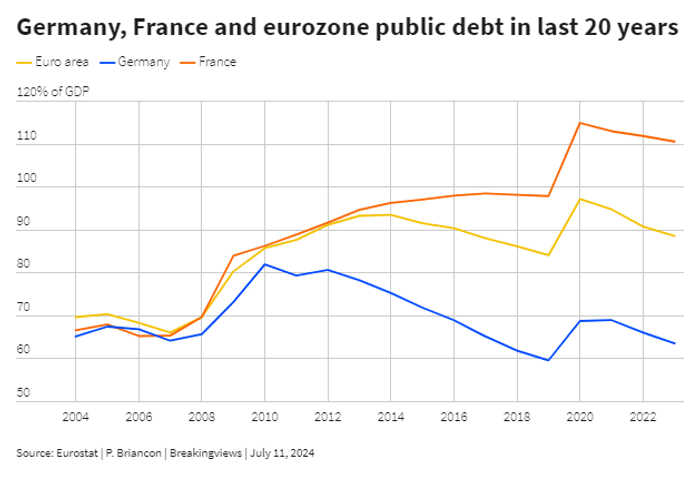

That leaves France at the mercy of investors who could worry about its ability to bring down a debt load that has doubled in the last 20 years. To stabilise it, Paris would need to cut its deficit before interest costs from the current near-3% of GDP to below 1%, according to a Breakingviews calculation assuming borrowing costs of around 3% and nominal growth of 3.2% in 2025, based on International Monetary Fund estimates. It has managed that just once since 2008. The most likely scenario is a fragile government allowing debt to continue drifting upwards.

Investors remained calm after Sunday’s vote, relieved that neither the far right nor the left obtained a majority. Paris, however, still has to pay a premium of more than 65 basis points over German debt to borrow for 10 years, up from below 50 basis points before the election. That looks low given Spain, with less debt load and faster growth, pays around 80 basis points. Whether or not yields shoot higher is for France’s future government to decide.

Updated 21:35 IST, July 11th 2024