Published 16:03 IST, May 30th 2024

Japan’s luxury boom sparks wishful China thinking

Year-on-year comparisons are flattering because Japan was late to re-open borders after Covid-19.

- Opinion

- 3 min read

Tokyo lights. Tokyo's boutiques are booming thanks to soaring demand for luxury labels. Executives have been quick to point to the return of China’s shopaholics as the reason. That, though, smacks of wishful thinking. Japan's downtrodden currency probably deserves more credit.

There is no doubting that Japan is “on fire”, as Prada CEO Andrea Guerra told the FT Business of Luxury Summit last week: the Italian company’s sales there grew nearly 50% in the three months to March from a year earlier. Industry leader LVMH reported “strong double-digit growth” over the quarter, while Richemont benefitted from a 20% bump in annual revenue from Japan, once stripped of currency effects.

Year-on-year comparisons are flattering because Japan was late to re-open borders after Covid-19. But LVMH, Richemont and Prada’s 2023 takings in Japan have far surpassed those recorded in their last full financial year before the virus curtailed global travel.

The Japanese splurge is fuelling expectations of a global resurgence in China’s overseas shopping, which executives at the three companies hailed as one reason behind the positive results. That would be good news for the sector, as it is currently facing headwinds. Chinese tourism spending, erased by the pandemic, had been a key engine for global bling: in 2018 Chinese shoppers made more than 70% of their estimated 85 billion euros of luxury goods purchases abroad, Bain data show.

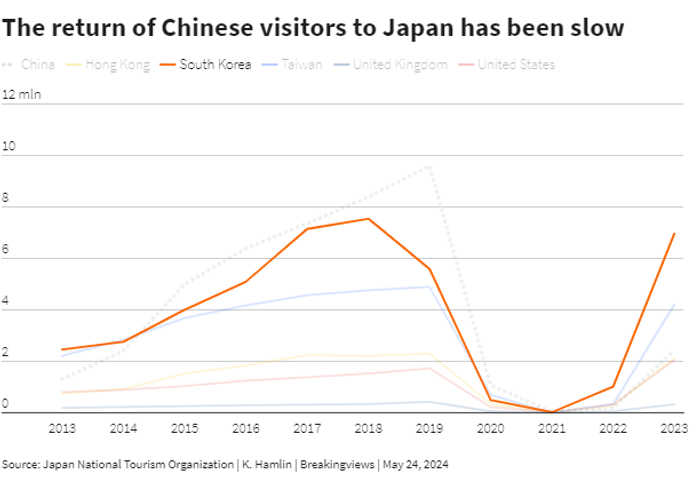

Yet the current picture looks more nuanced. Japan welcomed nearly 10 million visitors from the People's Republic at the peak in 2019, nearly a third of the total number of foreigners entering the country that year. But so far in 2024 less than 900,000 people from mainland China have entered the country, and they are outnumbered by arrivals from tiny Taiwan, according to the Japan National Tourism Organization (JNTO). Outbound travel from the People’s Republic is not expected to fully recover before 2025 or even later, analysts forecast.

Travellers are changing their ways, too. In 2023, Chinese tourists spent only 38% of their budget on shopping, down from more than half pre-pandemic, JNTO reckons. Many now prefer selfies to souvenirs, and short-haul over long-haul trips: inflation and more expensive airline tickets add up at a time when property prices, stocks and other stores of wealth languish. Chinese domestic travel has already surpassed pre-Covid highs, unlike outbound tourism. For mainland shoppers, there are new opportunities to spend closer to home, not least Hainan’s giant duty-free stores.

A better explanation for the splurge in Japan is probably the weak yen, which has fallen to a record low close to 158 yen to the dollar. Per capita spending by visitors to Japan hit the highest level in more than a decade last year.

For luxury investors, Japan’s shopping spree is welcome. But the yen’s slide may not last, and at any rate it is less exciting than a full comeback in Chinese tourists’ spending.

Updated 16:03 IST, May 30th 2024