Published 14:33 IST, August 13th 2024

China bond frenzy puts central bank in quandary

Chinese regulators have long expressed a wish to increase the proportion of direct financing.

- Opinion

- 2 min read

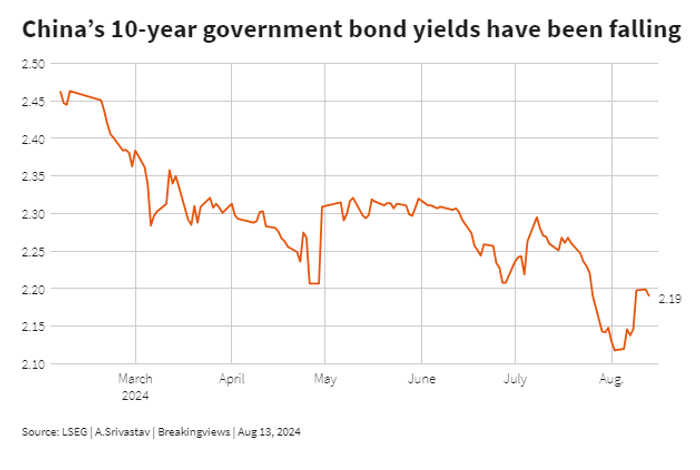

Market dilemmas. A quick look at China's bond market appears to show it has many of the ingredients for success. The country's leaders want it to develop more financing power, while investors have a big appetite for safe-haven assets. That ought to be a perfect match to help Beijing sell more government debt at lower cost. Trouble is, these factors are also creating excessive speculation, which is putting the central bank in a quandary.

Chinese regulators have long expressed a wish to increase the proportion of direct financing which, including bonds and stocks, accounted for only 31% of total social financing last year, per PBOC data, with the remainder dominated by bank loans. That compares with more than 70% in the United States. The central government is also planning to sell more long-dated sovereign bonds to raise funds to spur the $17 trillion economy.

The People's Bank of China, meanwhile, has spent most of the year squaring off with bond bulls who have been driving yields to record lows. A statement early last month that it was prepared to short-sell long-term securities cooled the bond frenzy for a time. Yet investors ignored the warning and started pouring money into government bonds again after the central bank's surprise rate cut three weeks later, betting more are in store.

The recent rush for government bonds fits perfectly with Beijing’s long-term agenda. But it complicates the PBOC's efforts to maintain a strong yuan, as a flattening yield curve lessens the bank's policy flexibility, and reinforces expectation of more monetary easing.

At least the PBOC no longer seems to be fighting alone. The interbank market watchdog has stepped up to investigate suspected bond market manipulation by regional banks. The securities regulator has also ordered some brokerages to inspect their bond trading activities, Reuters reported. The PBOC will welcome the reinforcements. The big question is whether they're enough to defeat the bond market bulls - whether in the market or in other parts of the government.

Updated 14:33 IST, August 13th 2024