Published 15:14 IST, September 23rd 2024

Beijing IPO meddling leaves bad taste in Hong Kong

The China Securities Regulatory Commission has put on hold three bubble tea makers' plans to list in Hong Kong.

- Opinion

- 3 min read

Promises, promises. Few people like it when an initial public offering flops on the first day. The People's Republic, though, is taking such dislike to a new and unwarranted level. The China Securities Regulatory Commission has put on hold three bubble tea makers' plans to list in Hong Kong, Reuters reported on Friday. Why? Because peers have performed badly. Such heavy-handed intervention will leave a bad taste in the city.

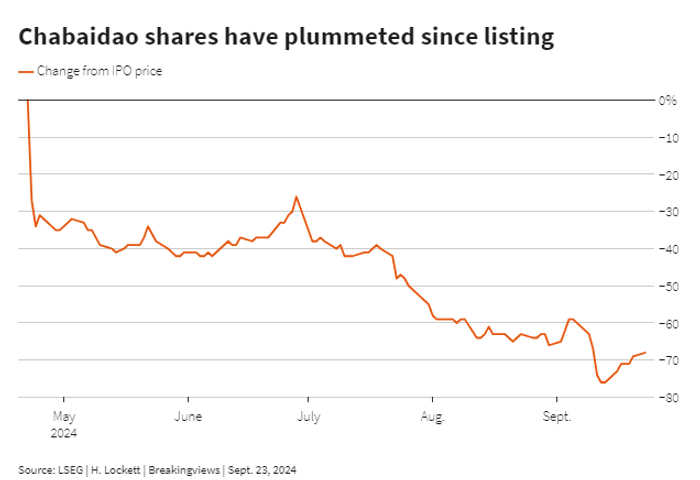

It's true that fellow boba-drink brewers have had a tough time. In China, the industry relies on breakneck expansion through franchisees, resulting in urban centres quickly becoming suffused with stores on every corner, keeping prices low and margins razor thin. Shares in Chabaidao fell by more than a quarter on their stock market debut. They now languish almost 70% below their IPO price after first-half profit fell by around a fifth compared to the same period last year.

It's an open question whether the trio that were hoping to brew up interest in an IPO would have fared any better. One of them, Mixue Bingcheng, at least has scale on its side. It's the country's largest bubble tea chain with around 36,000 stores, some four times more than its closest rival, Guming, and had been hoping to raise up to $1 billion in a Hong Kong listing.

Mixue's size may well be part of the problems. In April, the CSRC promised to encourage “leading enterprises of industries in the Mainland to list in Hong Kong”, following a new approvals regime for offshore IPOs that launched in March of 2023.

The ostensible goal of that regime was to restart overseas listing after years of drought following a crackdown on technology companies selling stock abroad. Instead, the new system has produced a massive backlog of offshore listings still waiting for approval from the CSRC. That is hardly "bolstering Hong Kong's financial centre status”, as the commission vowed to do in April.

Yet, whether or not to sell new stock in an unfavourable market is the domain of a company's executives and investment bankers. If they want to risk it - and if investors want to risk buying it - so be it.

Sure, delaying the flow of offshore IPOs will certainly prevent more embarrassing day-one drops by companies the market deems overvalued. But it will also prevent successful listings by companies looking for funding, making the Hong Kong bourse's attempts to shake off three lean IPO years all the harder. In attempting to pick winners, Beijing may simply end up putting them on ice.

Updated 15:14 IST, September 23rd 2024