Published 14:34 IST, July 19th 2024

Apple’s India ascent is a salve for China woes

The $3.4 trillion iPhone-maker's sales in India surged 33% to $8 billion during the 12 months to March.

- Opinion

- 2 min read

Green shoots. Apple is branching out in Asia. The $3.4 trillion iPhone-maker's sales in India surged 33% to $8 billion during the 12 months to March, Bloomberg reported on Monday, citing an unnamed source. That pales next to the $73 billion of annual revenue from Greater China, which includes Hong Kong and Taiwan, but the company is grappling with stiff competition and sluggish consumption there.

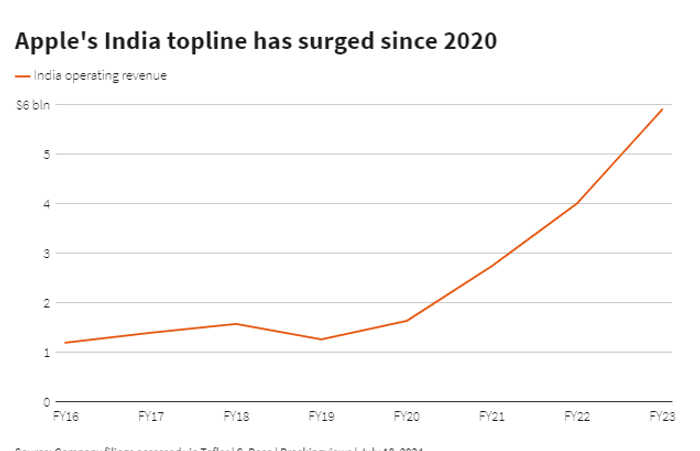

Apple has been ramping up its India presence over the last few years. One out of seven iPhones are now assembled in the country, Bloomberg reported in April and the retailer opened two stores in New Delhi and Mumbai last year. Between 2016 and 2023, sales in the country rose five-fold, per local filings.

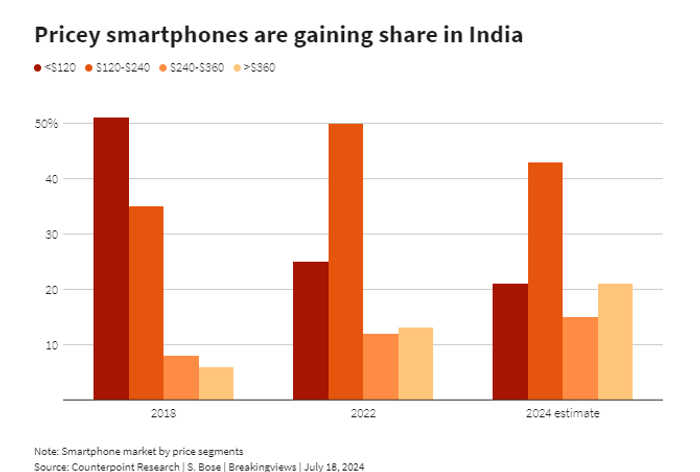

It's still early days, but Boss Tim Cook can thank booming consumer spending in premium segments which accelerated after the pandemic. Buyers snapped up a record 65,700 luxury apartments in 2022 and SUV sales made up more than half of all cars sold in India during the financial year to March 2023. High-end handsets are no exception: Shipments of smartphones priced over $800 are growing four times as fast as the overall market now worth $33 billion. Apple dominates that segment with a 69% share, with Samsung accounting for the rest, according to International Data Corporation.

That's a bright spot compared to the People's Republic, which boasts 47 Apple stores. In May, the Cupertino-based company reported an 8% year-on-year drop in second-quarter revenue from Greater China; Cook called the world's second-largest economy "the most competitive market in the world". Fierce rivalry with national champion Huawei, which unveiled its latest high-end model in April, plus anemic consumer spending, has forced Apple to offer steep price cuts.

India will become increasingly important to Apple's growth in the region as Chinese sales slow. The catch is that most Indian consumers currently buy premium phones through financing schemes, Counterpoint Research told Breakingviews. In November, the Reserve Bank of India tightened rules for personal loans and credit cards to curb risks. A slowdown in lending might squeeze iPhone and other luxury purchases.

For now though, the future looks bright. The ranks of India's ultra-rich are swelling – Knight Frank reckons by 2028, it will have risen 50% from the current level of 13,000, faster than anywhere else. Even if a $1,000 iPhone remains out of reach for much of the population, Apple's India bet may still pay off.

Updated 14:34 IST, July 19th 2024