Published 14:09 IST, July 17th 2024

Just started working? Find the best places to grow your monthly savings

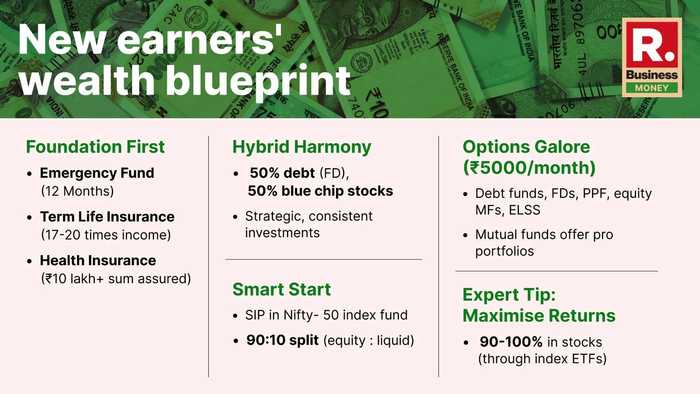

Young investors can build wealth on a budget by starting with a low-cost Nifty 50 index mutual fund SIP (90% equity, 10% liquid for emergencies).

- Money

- 4 min read

Newbie wealth essentials: Are you a newcomer to the workforce, and excited about stepping into the world of investment? Before you leap into the investment opportunities, experts highlight the utmost importance of laying down a solid foundation.

This entails establishing an emergency fund, obtaining term life insurance, and securing health insurance.

Arpit Suri, CA and personal finance expert, advises allocating 12 months' worth of expenses to a bank fixed deposit or a savings account with a sweep-in facility for the emergency fund.

In terms of term life insurance, Suri recommends a sum that is at least 17 to 20 times one's annual income, covering future expenses and liabilities.

Health insurance with a sum assured of at least Rs 10 lakh and a super top-up cover of Rs 50 lakh to Rs 1 crore is also suggested due to rising health inflation.

Smart start: Equity wealth

Once these basics are covered, young investors can shift their focus to wealth creation through equity investments. For those with a modest monthly budget, starting with an SIP (Systematic Investment Plan) in a low-cost Nifty-50 index mutual fund is recommended.

A 90:10 split between an equity fund and a liquid fund is suggested, with the latter serving as a backup for emergencies.

Aastha Gupta, CEO, Share India FinCap, recommends a 100 per cent equity allocation for young, first-time investors, either in an index fund or a diversified large-cap scheme.

Expected SIP returns on a multi-cap fund over a longer time frame are around 14 per cent to 15 per cent CAGR, while liquid funds offer returns in the range of 4 per cent to 5 per cent. In the case of cash constraints, a hybrid fund might be a more suitable option.

The choice between a static SIP and a stepped-up SIP depends on individual circumstances. A stepped-up SIP allows for an increase in the monthly investment amount at a predefined rate, taking advantage of compounding and accommodating an individual's growing income-earning capacity.

Hybrid for stability

For those concerned about market volatility, a hybrid fund is recommended, especially if they have family responsibilities and limited cash flow. Allocating 50 per cent to a debt instrument like a bank FD and the remaining to blue-chip stocks, can be a prudent strategy.

When it comes to the type of returns, equity is favoured over other asset classes for its potential to generate double-digit returns in the long run.

Gupta suggests adopting a strategic approach with consistent investments over an extended period to harness the power of compounding.

Options for every investor

For those looking to invest with Rs 5000 per month, there are various options to explore, ranging from low-risk schemes like debt funds, fixed deposits (FDs), Public Provident Fund (PPF), to high-risk options like equity mutual funds (MFs) and tax-saving funds (ELSS).

It's crucial to choose investment options based on individual risk tolerance and investment horizon.

Mutual funds, managed by fund managers, offer a diverse portfolio including equity funds, debt funds, index funds, hybrid or balanced funds, and tax-saving funds.

Aggressive hybrid funds, which allocate about 65 per cent to equities and 35 per cent to debt, are suitable for beginners, providing a balance between equity volatility and consistent returns.

Tax-saving funds, also known as ELSS funds, invest in relatively safer large-cap stocks and offer tax benefits under Section 80C of the Income Tax Act. They come with a lock-in period of three years, which can be advantageous for new investors dealing with market volatility.

Fixed deposits (FDs) serve as a low-risk avenue for young professionals starting their careers, providing stable returns with modest capital appreciation. With rising FD rates around 8-9 per cent, FDs offer a better option than savings bank accounts.

The Public Provident Fund (PPF) is a government-backed, tax-saving investment with a 15-year lock-in period. While it may not always offer inflation-beating returns, its tax-saving benefits make it an option to consider.

Experts suggest that younger investors, with a longer time horizon, should consider allocating 90 per cent to 100 per cent of their assets to stocks, preferably through mutual funds or index ETFs, to maximise potential yields over time.

Updated 14:10 IST, July 17th 2024