Updated 14:54 IST, July 30th 2024

Old vs New Tax Regime: Find out which option suits you best

The New tax regime is now default; file Form 10-IEA by the due date to opt for the Old regime, or you'll default to the New regime and lose most deductions.

Old vs New tax regime: Deciding whether to stay with the old tax regime or switch to the new one? Here’s a straightforward comparison to help you make an informed choice. The Union Budget 2024 has introduced revisions to the tax slabs under the New Regime.

Taxpayers can now potentially save up to Rs 17,500 on taxes. Additionally, the standard deduction has been increased to Rs 75,000, and the family pension deduction has been raised to Rs 25,000 from Rs 15,000 for FY 2024-25.

Tax bracket changes

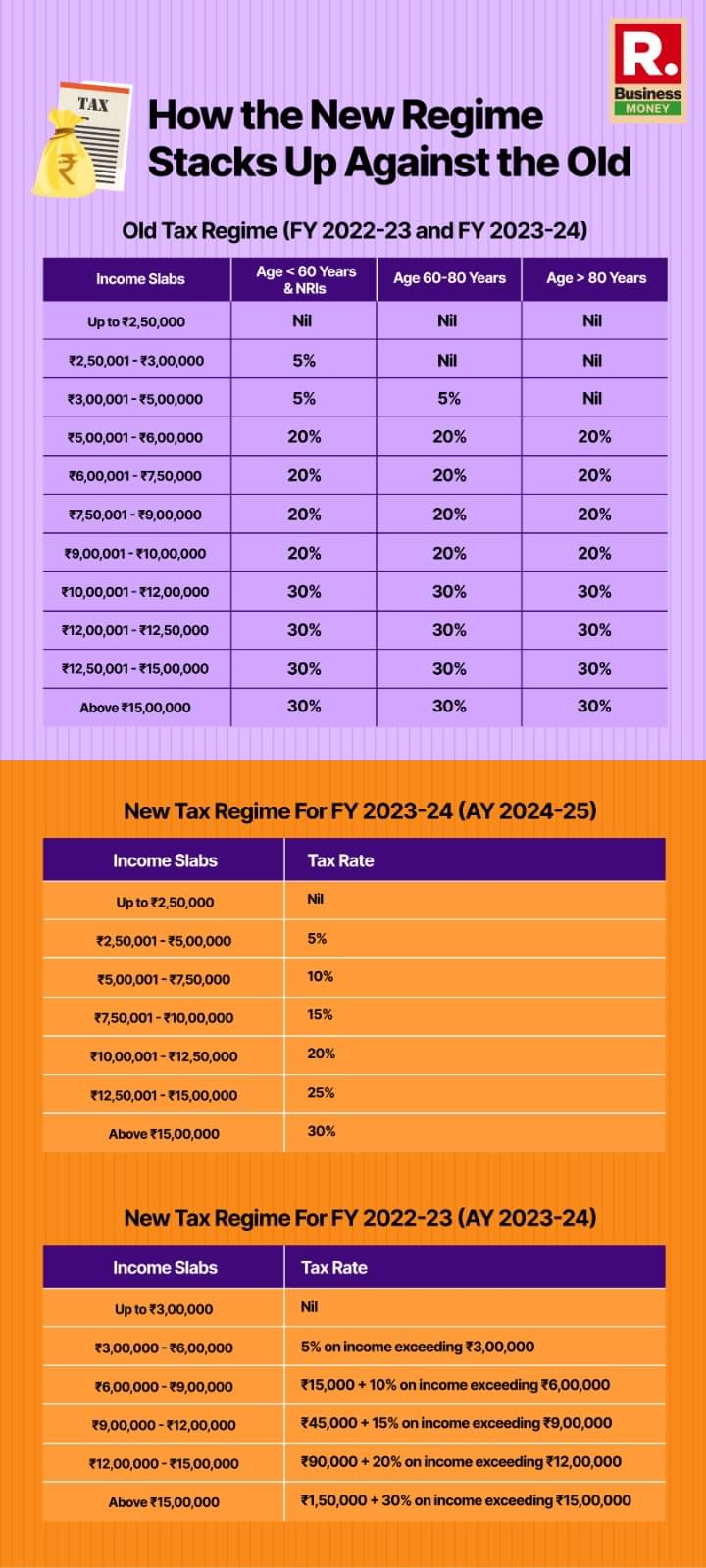

The comparison of the old and new tax regimes reveals several changes in tax slabs and rates between FY 2022-23 and FY 2023-24. For individuals under the old tax regime, income up to Rs 2,50,000 was tax-free, with incremental rates of 5 per cent for income between Rs 2,50,001 and Rs 3,00,000, and up to 30 per cent for incomes exceeding Rs 15,00,000.

The new tax regime for FY 2022-23 introduced a simplified slab system with lower rates, starting at 5 per cent for incomes above Rs 2,50,000, and rising to 30 per cent for incomes over Rs 15,00,000.

In FY 2023-24, the new regime was adjusted to further refine tax slabs. The tax-free threshold was increased to Rs 3,00,000, with 5 per cent applied to incomes from Rs 3,00,000 to Rs 6,00,000, and a tiered increase for higher brackets: 10 per cent on income over Rs 6,00,000, 15 per cent on income over Rs 9,00,000, 20 per cent on income over Rs 12,00,000, and 30 per cent for incomes exceeding Rs 15,00,000.

Income tax is structured based on a slab system, with different tax rates applied to different income ranges. As income increases, the tax rate also rises, creating a progressive tax system. The tax slabs are typically updated in each budget.

Comparing rebates and exemptions

Old Regime:

- Rebate up to Rs 12,500 if total income does not exceed Rs 5,00,000 (Not applicable for NRIs).

- Exemption limits:

- Up to Rs 2,50,000 for individuals below 60 years and NRIs.

- Up to Rs 3,00,000 for senior citizens aged 60 to 80 years.

- Up to Rs 5,00,000 for super senior citizens aged above 80 years. - Surcharge and Cess: Applicable above the tax rates.

New Regime:

- Rebate up to Rs 25,000 if total income does not exceed Rs 7,00,000 (Not applicable for NRIs).

- Exemption Limit: Up to Rs 3,00,000 for individuals opting for the new regime.

- Surcharge and Cess: Applicable above the tax rates.

Filing requirements

For FY 2022-23: The default regime was the Old tax regime, with Form 10-IE required to opt for the New tax regime. Post due date, filing was mandatory under the Old regime.

For FY 2023-24: The default regime is now the New tax regime. To opt for the Old tax regime, Form 10-IEA must be filed within the due date. After the due date, taxpayers must file under the New regime, giving up most deductions and exemptions.

Published 14:52 IST, July 30th 2024