Published 12:39 IST, October 3rd 2024

Beware hallucinations in AI chipmaker IPO

Cerebras, a newcomer backed by venture capitalists including Altimeter and Benchmark, wants to break the stranglehold.

- Markets

- 3 min read

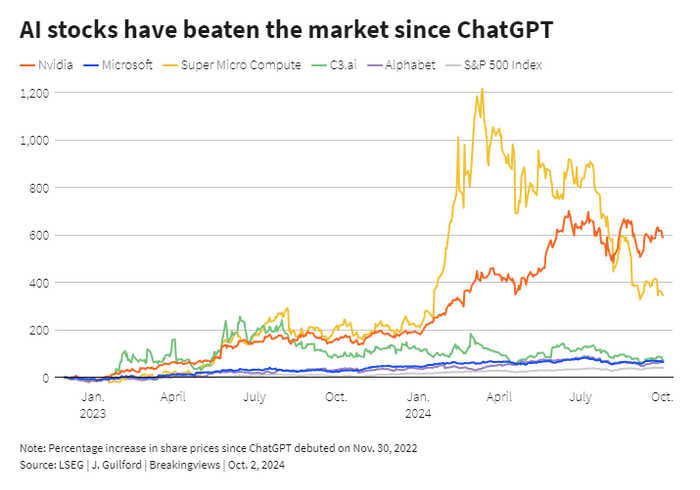

Perception isn’t reality. ChatGPT lit a capital fuse in artificial intelligence, especially for its silicon masters. Nvidia chips, essential for training AI models, have prompted a nearly 600% increase in its market value since OpenAI’s chatbot exploded onto the scene almost two years ago. Rival Cerebras Systems is aiming to piggyback on the exuberance, but its appeal might be as hallucinogenic as the nonexistent patterns spotted by large language models.

Human-like machines require ever-greater resources. Microsoft and OpenAI have been drawing up plans for a data center project that could cost $100 billion, dubbed Stargate, The Information reported. Nvidia, led by Jensen Huang, practically has a lock on the powerful graphics processing units and other semiconductors powering the efforts.

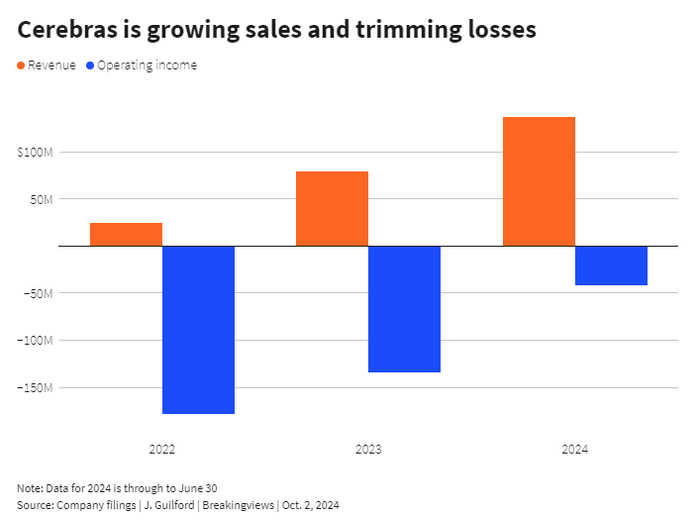

Cerebras, a newcomer backed by venture capitalists including Altimeter and Benchmark, wants to break the stranglehold. It produces huge arrays of processing cores infused with super-fast memory. Initial public offering documents disclosed on Monday tout superior performance. Its $136 million of revenue in the first half nearly doubles what the company generated in all of 2023. While it is unprofitable, operating losses have narrowed to about a third of the top line from more than 100%.

There’s one big asterisk, however. A single customer, Abu Dhabi-based AI developer G42, has bought 97% of the hardware sold by Cerebras this year, essentially representing all of the unit’s growth.

Moreover, the relationship gets even knottier. G42 is a major investor, too. If it submits sufficiently large purchase orders, it can buy more shares at a hefty discount. Circular relationships are no oddity in AI, but this one is particularly existential. G42 promised to spend $1.4 billion with Cerebras itself or through third parties, an arrangement that practically guarantees meteoric growth.

There are other prospects, including a recently signed agreement with Saudi Aramco, but significant risks exist, too. For example, U.S. national security regulators could nix exports, which also get screened by the Commerce and Treasury departments. G42 is, thus far, only deploying Cerebras technology in the United States. And with a target valuation as high as $8 billion, according to Bloomberg, it would be worth an eye-popping 29 times annualized first-half revenue.

Even with guaranteed income, Cerebras isn’t obviously seeking rapid expansion. Its research spending is running at roughly the same rate as over the past two years, a puny $155 million, annualized, next to Nvidia’s $3 billion just last quarter. AI hype and a potential Huang rival will inevitably attract fund managers, especially after the 128% gain in chip designer Arm’s shares since its IPO a year ago. But they also may see prospects that aren’t really there.

Context News

Cerebras Systems, a technology startup producing chips designed to power artificial intelligence applications, on Oct. 1 disclosed its prospectus for an initial public offering. The company is backed by investment firms Alpha Wave, Altimeter, Benchmark, Coatue, Eclipse Ventures and Foundation Capital, as well as G42 Funds, an arm of Abu Dhabi-based AI developer G42. Cerebras may seek to raise $1 billion at a valuation between $7 billion and $8 billion, Bloomberg reported on Sept. 25, citing unnamed sources.

Updated 12:39 IST, October 3rd 2024