Published 19:02 IST, October 20th 2024

HDFC Securities Stock Picks: Top 10 Stocks for Diwali 2024

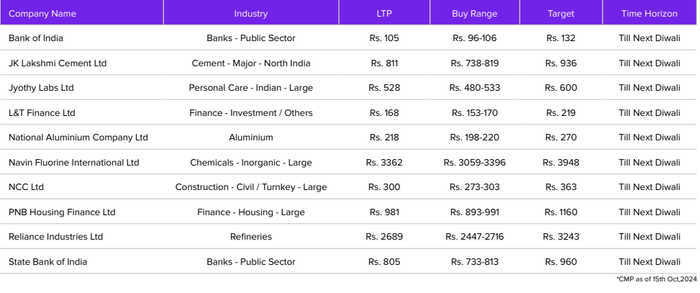

The brokerage has recommended a portfolio of 10 stocks, blending well-established mega-caps with mid- and small-cap companies.

- Markets

- 5 min read

Diwali 2024 stock picks: The Indian stock market has witnessed an extraordinary rally over the last four and a half years, particularly since the pandemic lows of March 2020. With a 24 per cent corporate earnings growth in Nifty-50 stocks from FY21 to FY24, and increased retail investor participation through systematic investment plans (SIPs), mutual funds, and insurance companies, stocks have seen a re-rating, generating stellar returns. However, with the current rich valuations, many stocks across sectors offer limited margin of safety, and global events could trigger significant market corrections. Amid this environment, HDFC Securities has curated a balanced portfolio of 10 stocks for Diwali 2024, targeting moderate returns with limited downside risk.

Market Overview: Mixed Sentiments Amid Global Uncertainty

Since the pandemic-induced lows, Indian stock indices have not seen a significant correction, supported by strong earnings growth and retail investor engagement. However, global risk factors remain high. The 2024 U.S. presidential election is one such factor, with potential economic, tax, or trade policy changes that could ripple through global markets. While the U.S. Federal Reserve's recent rate cuts have reduced borrowing costs, policy divergence among major central banks and geopolitical risks like the Middle East conflict could heighten volatility in financial markets.

China’s recent fiscal and monetary stimulus has attracted flows that may challenge India’s position in the short term. However, India’s strong long-term growth narrative, driven by its demographic dividend, digital adoption, and entrepreneurial ecosystem, continues to offer a compelling opportunity for global investors. With its rising weight in global indices and foreign portfolio investments (FPIs) showing signs of strengthening amid a weakening U.S. dollar, India remains an attractive investment destination.

HDFC Securities' Stock Picks

HDFC Securities has constructed a portfolio of 10 stocks, blending well-established mega-caps with mid- and small-cap companies. These stocks are chosen to provide superior upside potential while mitigating downside risk.

Bank of India (BOI)

- Sector: Public Sector Banks

- Target Price: Rs 132 (Current: Rs 105)

Outlook: BOI is the sixth-largest public sector bank in India, and its Q1FY25 performance shows a robust 12 per cent YoY increase in total business. The bank's focus on Retail, Agriculture, and MSME (RAM) lending has driven impressive growth, with retail advances up 20 per cent YoY. The bank is trading at an attractive valuation with a price-to-book ratio of 0.6x for FY26. HDFC Securities recommends a buy for the Rs 96-106 range, expecting a 25 per cent upside by next Diwali.

JK Lakshmi Cement Ltd

- Sector: Cement - North India

- Target Price: Rs 936 (Current: Rs 811)

Outlook: JK Lakshmi Cement has a strong foothold in Northern, Western, and Eastern India. The company has been expanding its capacity, currently at 16.4 MTPA, with plans to increase it to 24 MTPA by FY27. Despite a soft pricing environment, the company’s operational efficiency improvements and focus on renewable energy (39 per cent of total energy use) provide a promising outlook. HDFC Securities suggests buying between Rs 738 and Rs 819 for a potential 15 per cent upside.

Jyothy Labs Ltd

- Sector: Personal Care - FMCG

- Target Price: Rs 600 (Current: Rs 528)

Outlook: Jyothy Labs, known for its flagship brand ‘Ujala,’ has demonstrated steady growth, especially in its fabric care segment, which commands an 83 per cent market share in the whitener category. The personal care segment, with brands like Margo, has also shown robust growth, contributing to the company’s premiumisation strategy. With a buy recommendation at Rs 480-533, the stock could see a moderate 14 per cent return.

L&T Finance Ltd

- Sector: Financial Services

- Target Price: Rs 219 (Current: Rs 168)

Outlook: L&T Finance has shown resilience in the financial services sector, focusing on strengthening its investment and lending portfolios. With an attractive price band of Rs 153-170, the stock could deliver up to 30 per cent returns over the next year.

National Aluminium Company Ltd (NALCO)

- Sector: Aluminium

- Target Price: Rs 270 (Current: Rs 218)

Outlook: NALCO has a dominant position in the aluminium industry, and with global demand for metals rising, the company is well-poised for growth. HDFC recommends a buy at Rs 198-220, expecting a 24 per cent upside.

Navin Fluorine International Ltd

- Sector: Chemicals

- Target Price: Rs 3948 (Current: Rs 3362)

Outlook: Navin Fluorine is a leader in the inorganic chemicals segment, benefiting from strong demand in pharmaceuticals and agrochemicals. The company is set for significant growth, and HDFC suggests buying in the Rs 3059-3396 range.

NCC Ltd

- Sector: Construction - Civil/Turnkey

- Target Price: Rs 363 (Current: Rs 300)

Outlook: NCC is a top player in India’s construction sector, with a strong order book and growing revenue. With a target price of Rs 363, the stock offers a 20 per cent upside.

PNB Housing Finance Ltd

- Sector: Housing Finance

- Target Price: Rs 1160 (Current: Rs 981)

Outlook: PNB Housing is well-positioned to benefit from India's growing real estate demand, particularly in affordable housing. The stock could appreciate by 18 per cent over the next year.

Reliance Industries Ltd

- Sector: Refineries

- Target Price: Rs 3243 (Current: Rs 2689)

Outlook: Reliance Industries remains a market leader, with its diversified portfolio across oil refining, telecom, and retail. The stock offers a strong upside of 20 per cent with a buy recommendation in the Rs 2447-2716 range.

State Bank of India ( SBI )

- Sector: Public Sector Banks

- Target Price: Rs 960 (Current: Rs 805)

Outlook: SBI , India’s largest public sector bank, continues to show strong fundamentals with improving asset quality and a robust lending portfolio. HDFC Securities expects a 19 per cent upside with a target price of Rs 960.

(Disclaimer: This article is based on a research report by HDFC Securities. Investors are advised to do their own research, and consult experts before making any investment decisions.)

Updated 16:42 IST, October 21st 2024